My revenue with Worldline: Keeping track and things to know

Table of Contents

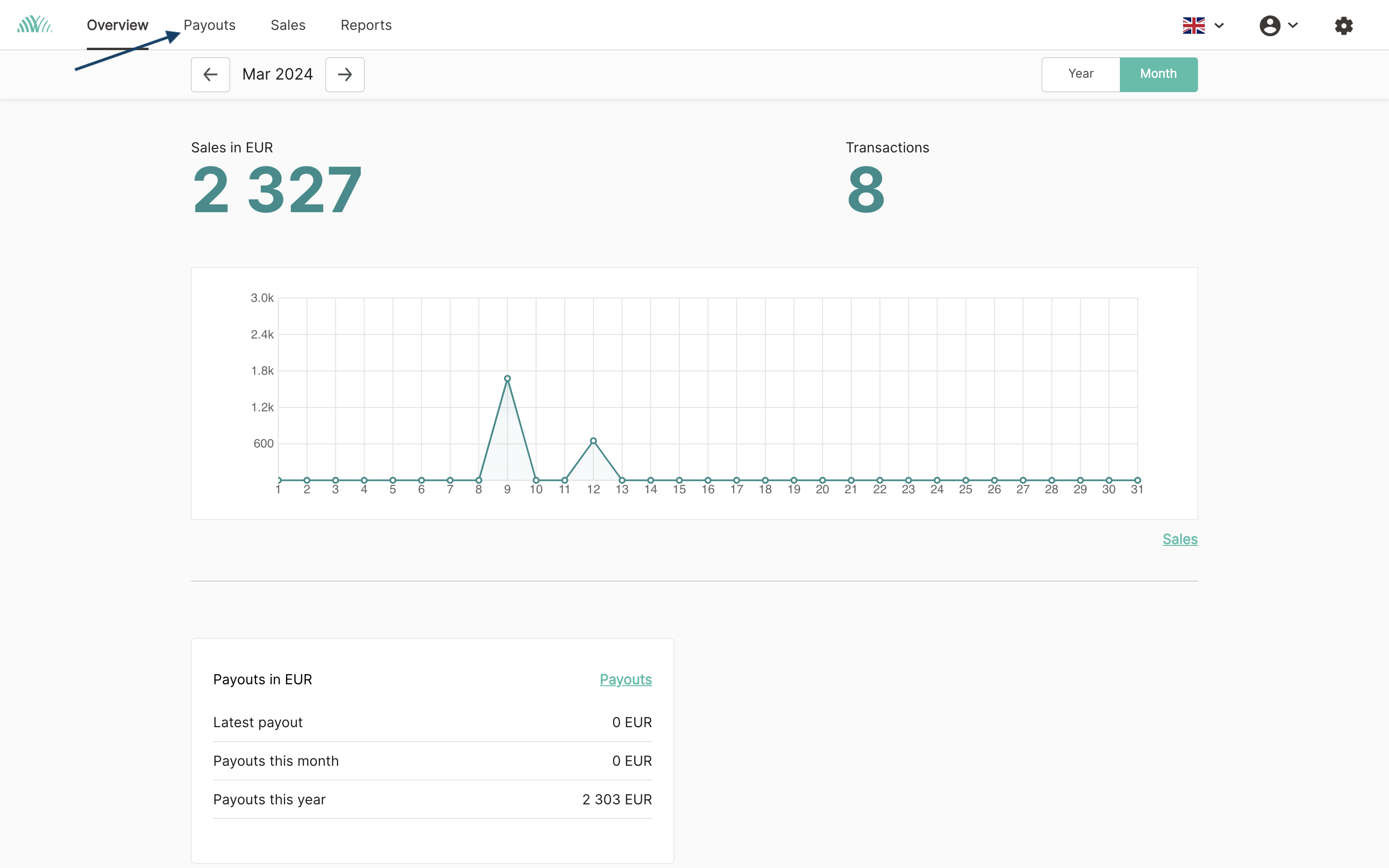

Do you need to check the accounting of your bank account? Then the overview of Worldline's payouts will help you!

Let's go

- Open reports.bambora.com.

- Log in with your Worldline credentials.

- Click on the “Payouts” tab on the top row of the page to view Worldline's payouts and download them as PDF or Excel files to your computer.

- Click on “Payouts.”

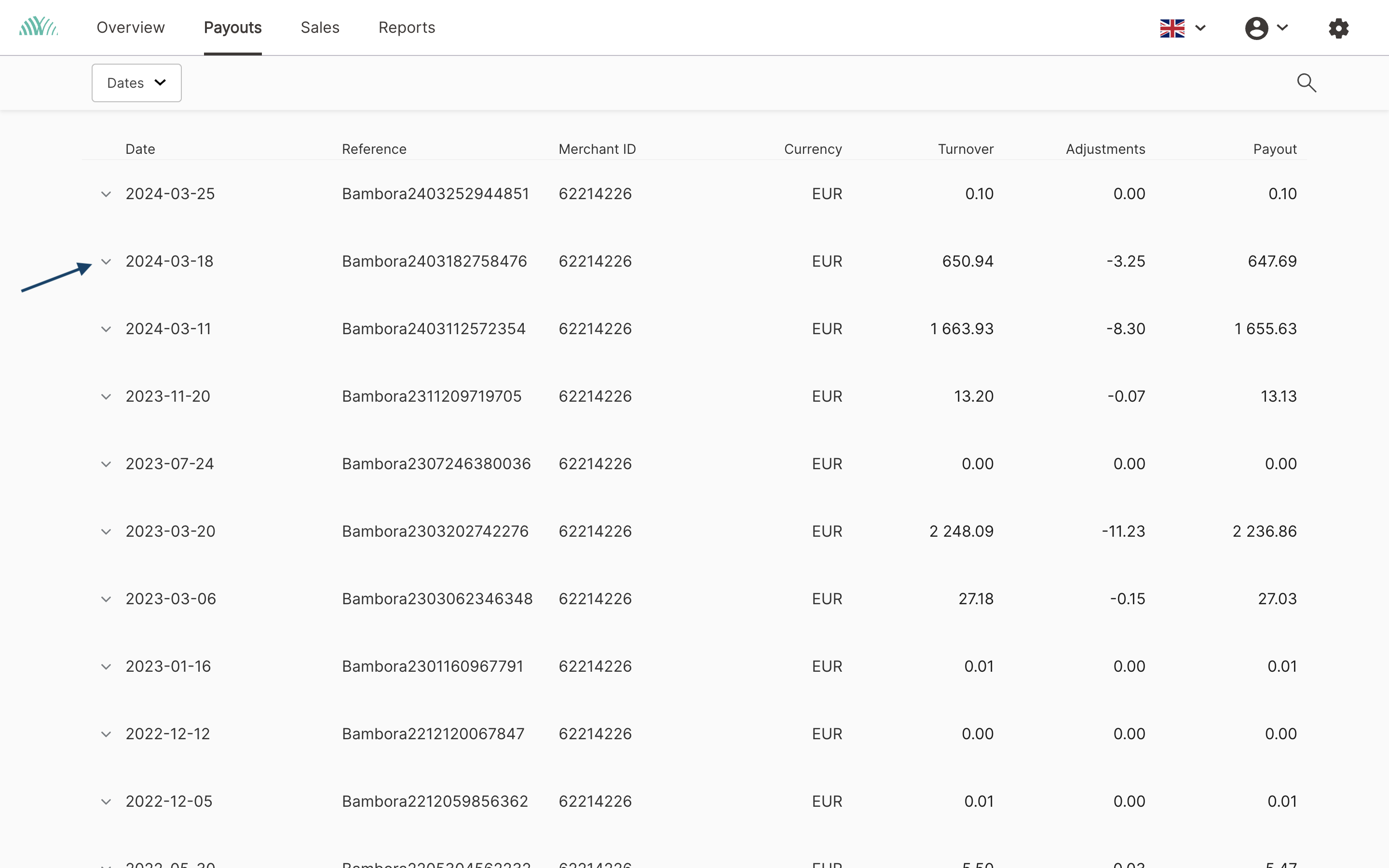

- You will see an overview of all payouts. Then, select a payout you want to know more about and click on the arrow near the date

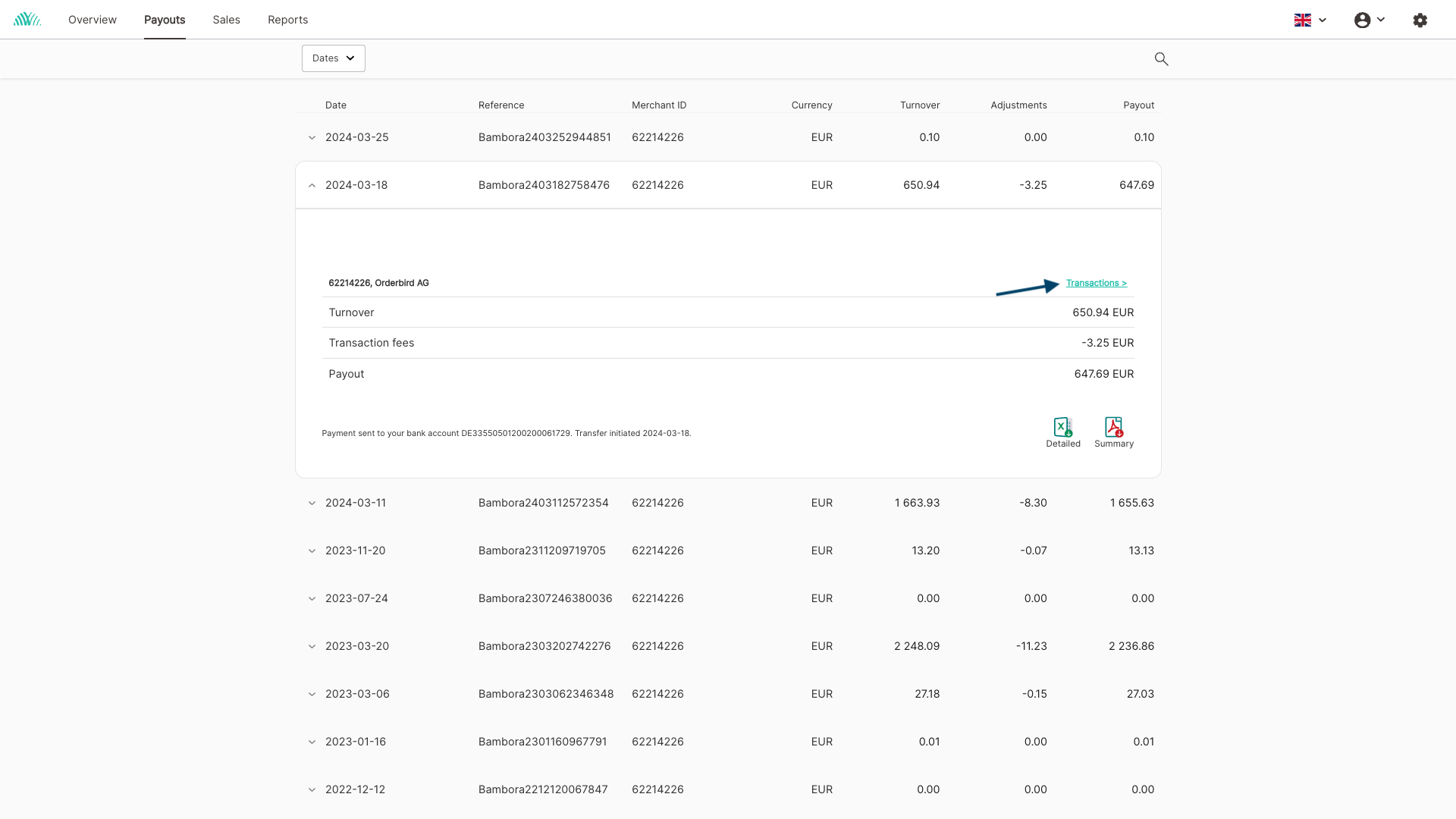

- You will now see the turnover, the transaction fees, and the actual amount paid out to you.

Any questions?

How can I get even more information?

- Do you need more information? Then click on “Transactions”.

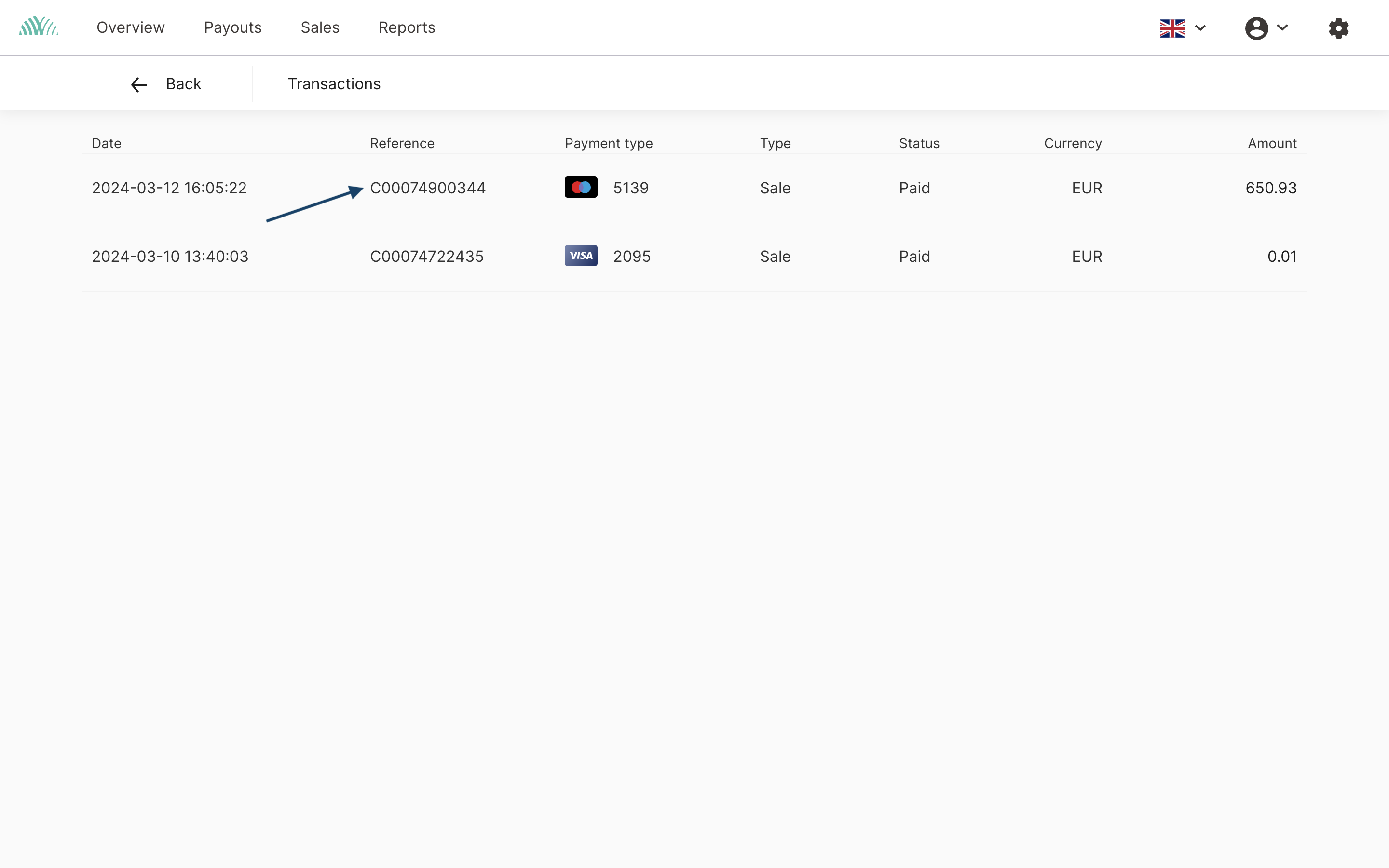

- Now you see an overview of the individual card transactions that make up the total “Sale”.

If you want to know more about a single card transaction, click on the reference number:

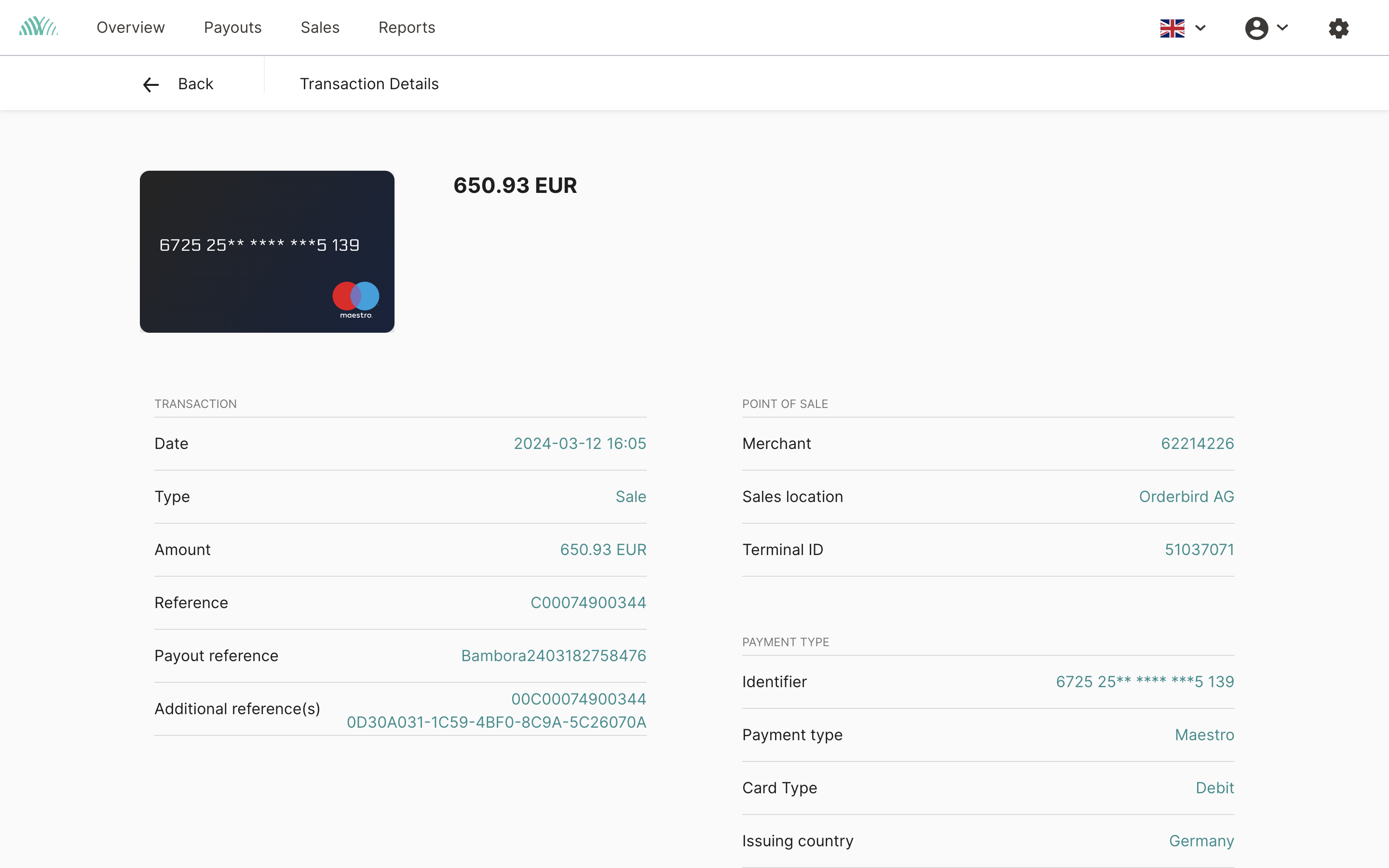

- Transaction Details: Here you can see the information about this single transaction:

How can I set a specific time frame?

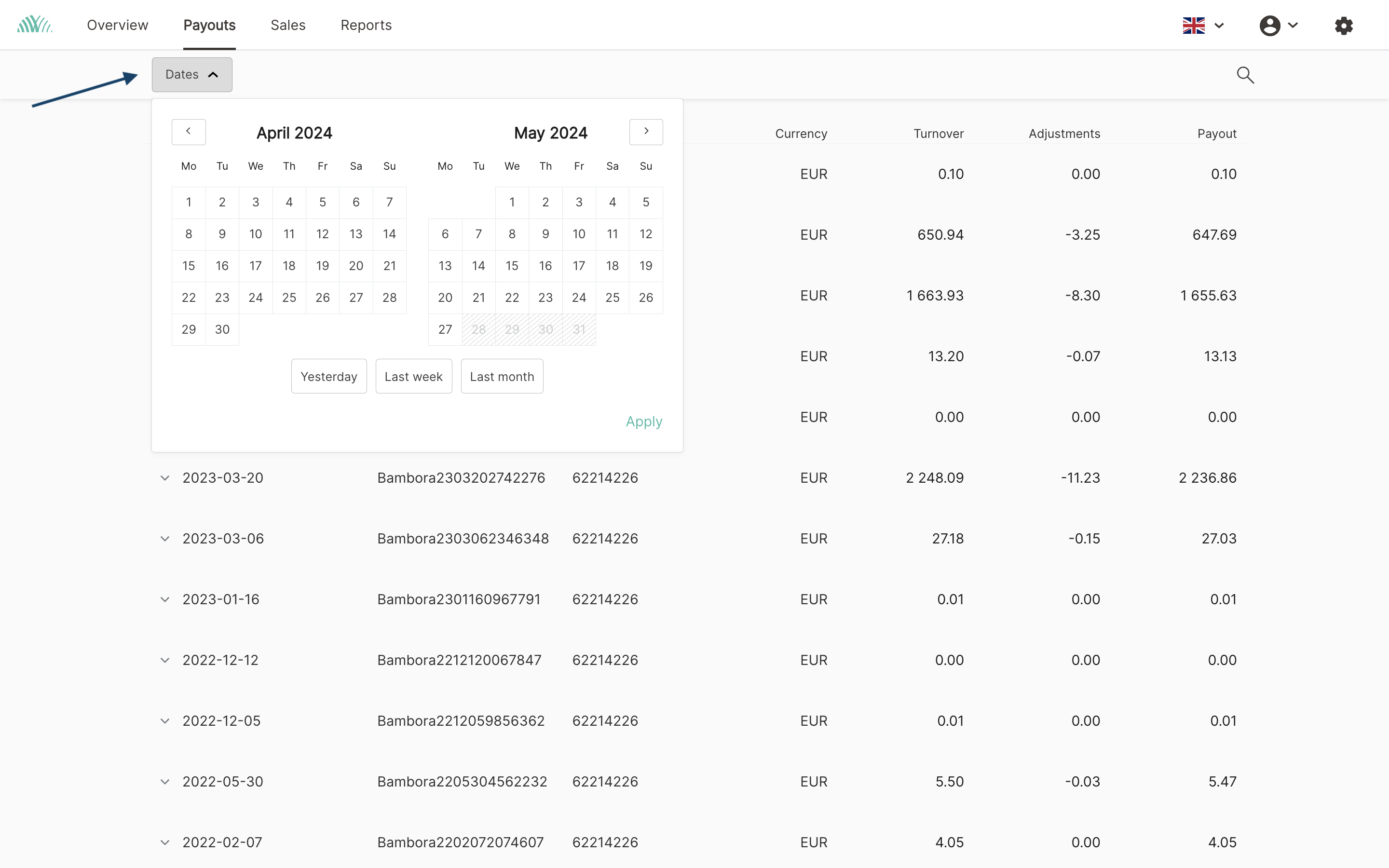

You are looking for payouts from a specific time frame? No problem: Use the “Dates” field in the upper left corner to display all payouts for your desired time frame. If you are looking for a specific reference number, you can find it using the search bar “References” in the upper right corner:

Do I need to know anything else regarding the amount of the payouts?

Yes: Please get in touch with your bank in advance if you expect a transaction of at least €12,500. Your bank must report this transaction to the Deutsche Bundesbank and thus follow the “AWV Meldepflicht” (AWV reporting obligation). So please be aware of this if for example your payout frequency is not daily or if you expect an extraordinarily high income due to an event.

Tax-free disagio

Did you know, that the disagio, meaning the transaction fees, is tax-free!

About legal and tax consulting

orderbird does not offer legal or tax advice. Everything we write reflects our experience and the experience of our customers. Any information with legal or tax aspects is in no way to be considered legal or tax advice. Therefore, this approach may not apply to you and your business in particular.

For binding statements, please contact your tax advisor. orderbird accepts no liability for the topicality, accuracy and completeness of the information that orderbird provides here with regard to tax law procedures.

Important information for your accounting regarding the invoicing of the transaction fees with VAT.

VAT is not applied to transaction fees for card payments that are processed by a foreign provider in Germany (this includes Worldline). This is due to the so-called reverse-charge system. Therefore, your fees will not be invoiced and not be charged separately, as is the case with other national providers.