Let's start

It's almost closing time! Time for your daily business closing. With the orderbird cashbook there are just two steps to take: First you do a cash counting via "cash balancing", followed by closing the calendar day via "close day". And you're done!

Very important: The cashbook day sheet is NEVER closed automatically. Not even if you close the shift in the orderbird app. So please keep in mind that after closing the shift in the app you will still have to do the cash balancing and the closing of the calendar for your orderbird cashbook!

Step by step

- Close the shift in the orderbird app.

- Go to the cashbook and tap on "Cash balancing" and make sure to compare the debit balance with the actual amount of cash in your point of sale. You can find out how to do this here: How do I do a cash check?

- If you notice any discrepancies between the actual amount of cash in your point of sale and the sum of the debit balance, you have to act immediately: This is your chance to complete forgotten entries or correct erroneous entries. In doing so, you adjust the amount of cash in your point of sale to the sum of the debit balance. Remember to carefully document and comment on everything! How can I correct wrong entries or forgotten entries? Save the result of your cash balancing before you make a correction entry.

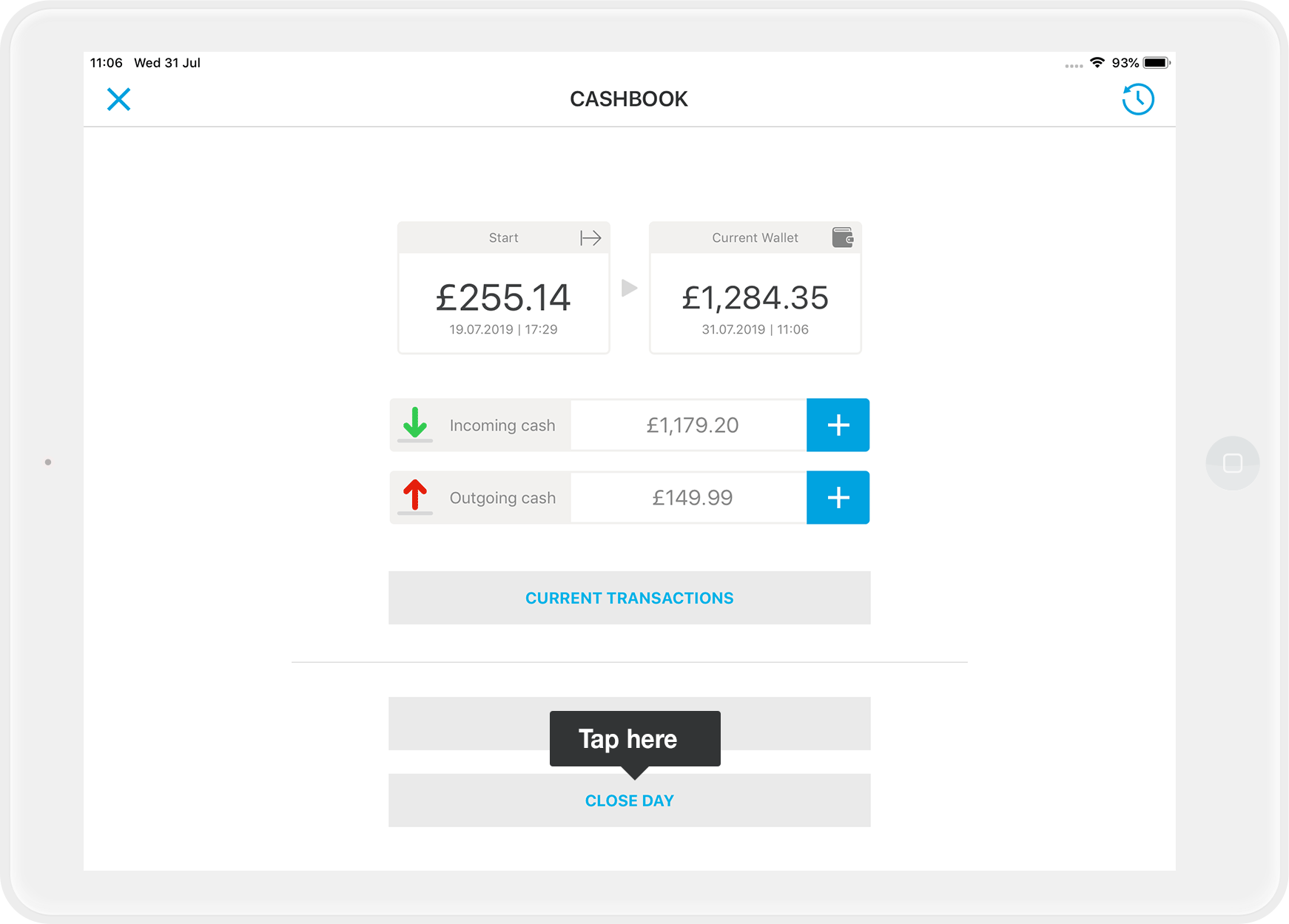

- If the actual amount of cash in your point of sale corresponds to the sum of the debit balance, then save the result of your cash check and tap on "Close day" on the main page of the cashbook.

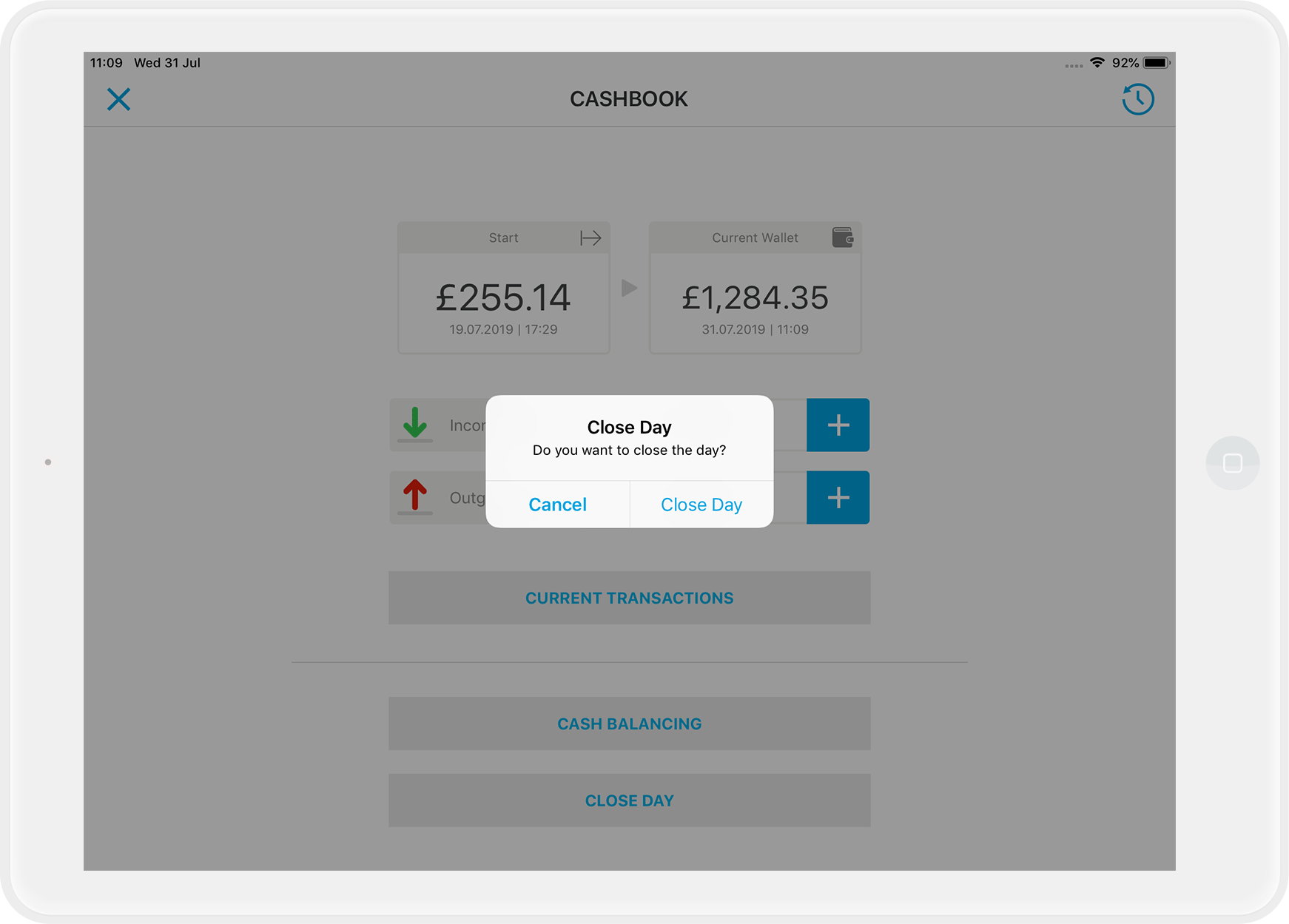

- Confirm your entry by tapping on "Close day".

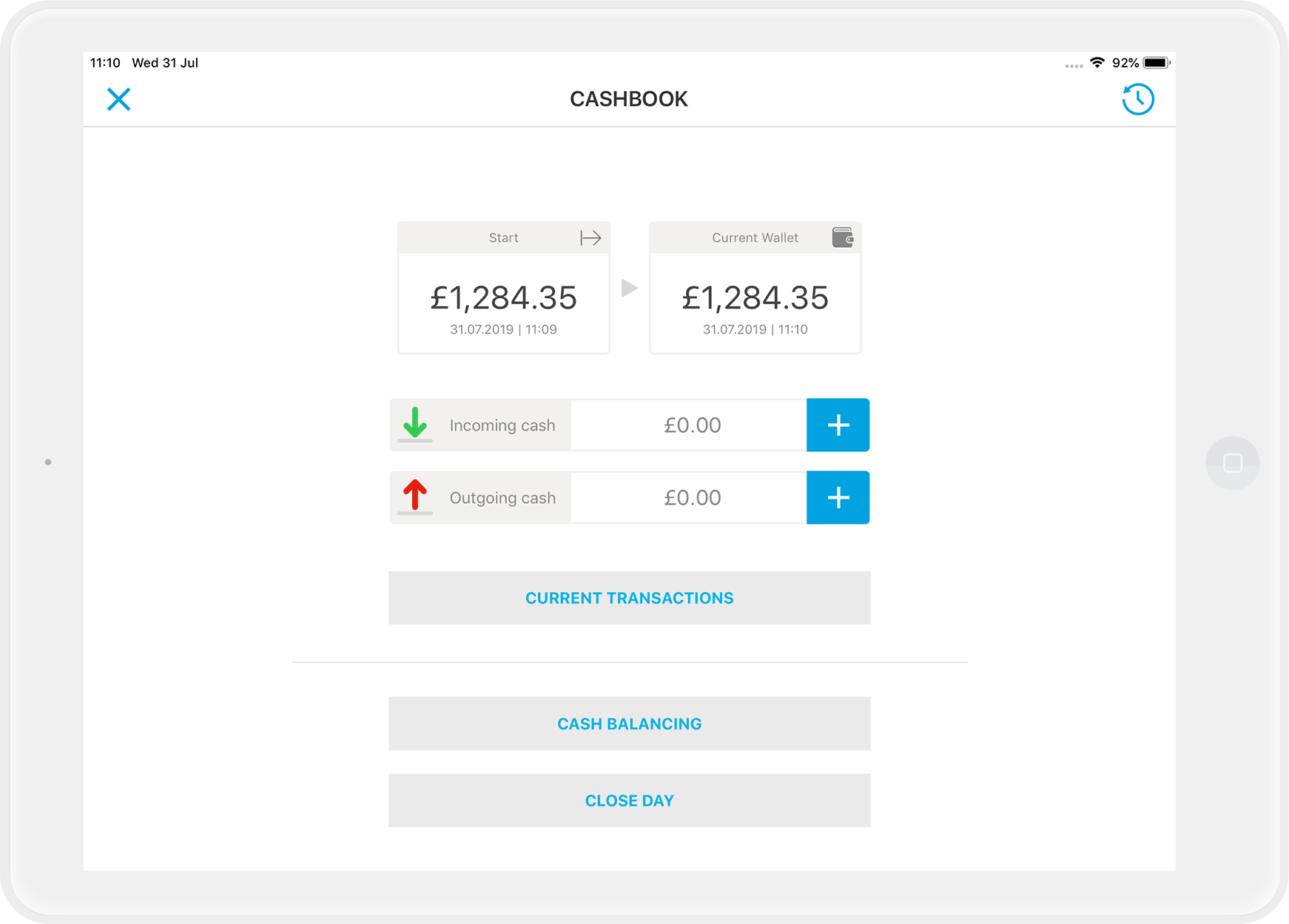

- Now you can see that the "start" amount equals "current wallet" as well as "Incoming" and "Outgoing Cash" are back to zero.

About closing the day

You can no longer record any cash income or cash expenses for a closed cash sheet, as it can no longer be adjusted or manipulated according to legal regulations. If you notice a mistake afterward, please contact your tax advisor to clarify how best to proceed.

Check with your tax advisor whether the following approach makes sense for you: How can I correct wrong entries or forgotten entries?

About legal or tax advice

orderbird does not offer any legal or tax advice. All information with legal or tax aspects is in no case to be regarded as legal or tax advice.

However, in order to provide you with the most reliable guidance possible, our cooperation partner, the Berlin-based tax firm Buder (https://steuerbuder.de), has examined the following procedure for dealing with the orderbird cash book and found it to be correct with regard to tax-relevant aspects. Nevertheless, it is possible that the procedures suggested here are not applicable to you and your company in particular.

Therefore please contact your tax advisor for a binding statement on how to use the orderbird cashbook correctly. Both orderbird and Steuerkanzlei Buder exclude any liability for the topicality, correctness and completeness of the information provided here by orderbird with regard to tax procedures.