How can I provide individual pages of my cash book to my tax advisor or for a financial audit?

Table of Contents

With a PDF export! The PDF will be sent directly to the e-mail address with which you registered at my.orderbird. You can then print it out for your records or forward it to your tax advisor digitally.

You can only export completed cash register sheets one by one. If you want to create an export of several checkout sheets, take a look here: How can I export the data from my Cashbook as a CSV file?

Let's go

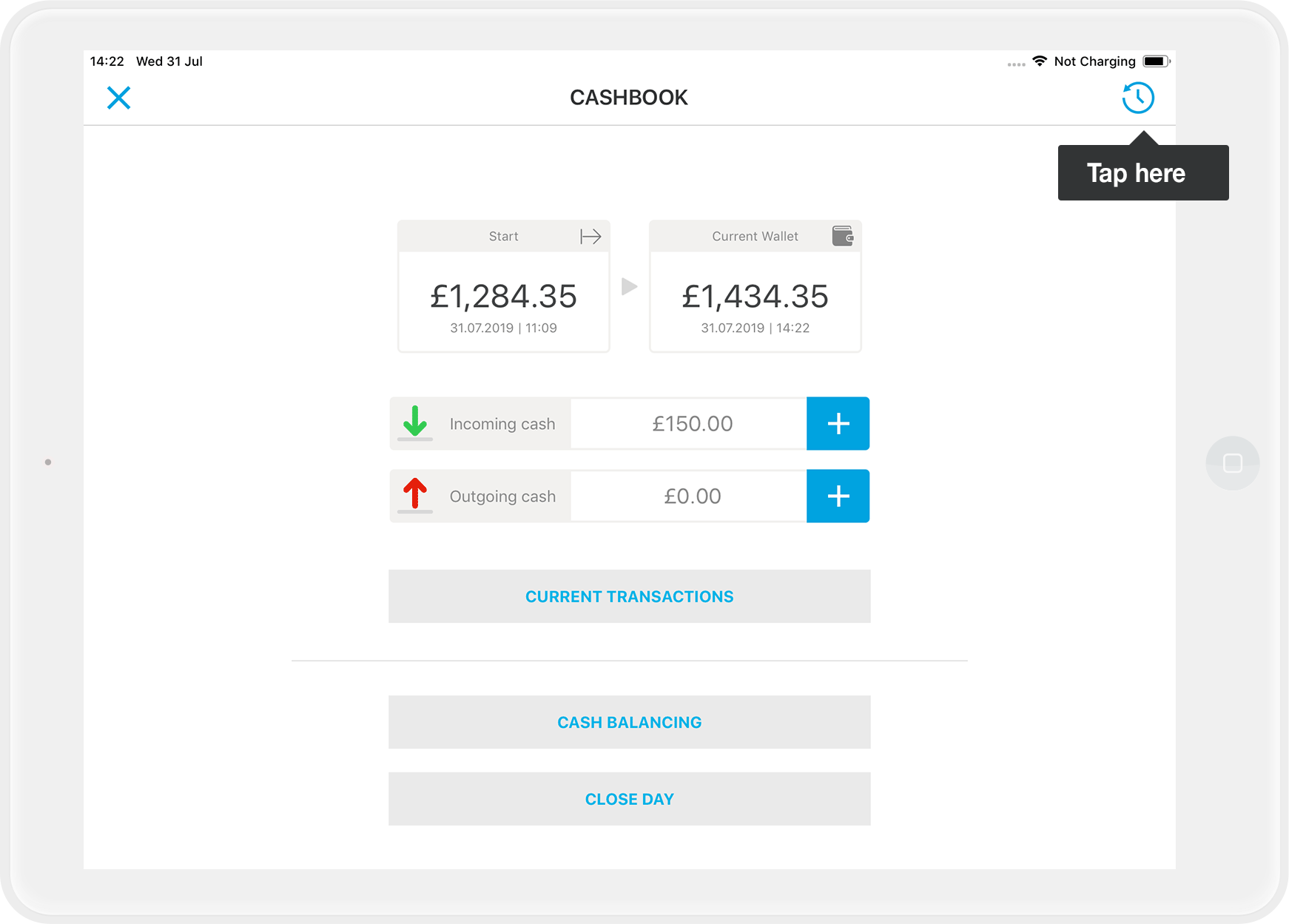

- On the main page of the cash book, tap on the clock symbol at the top right.

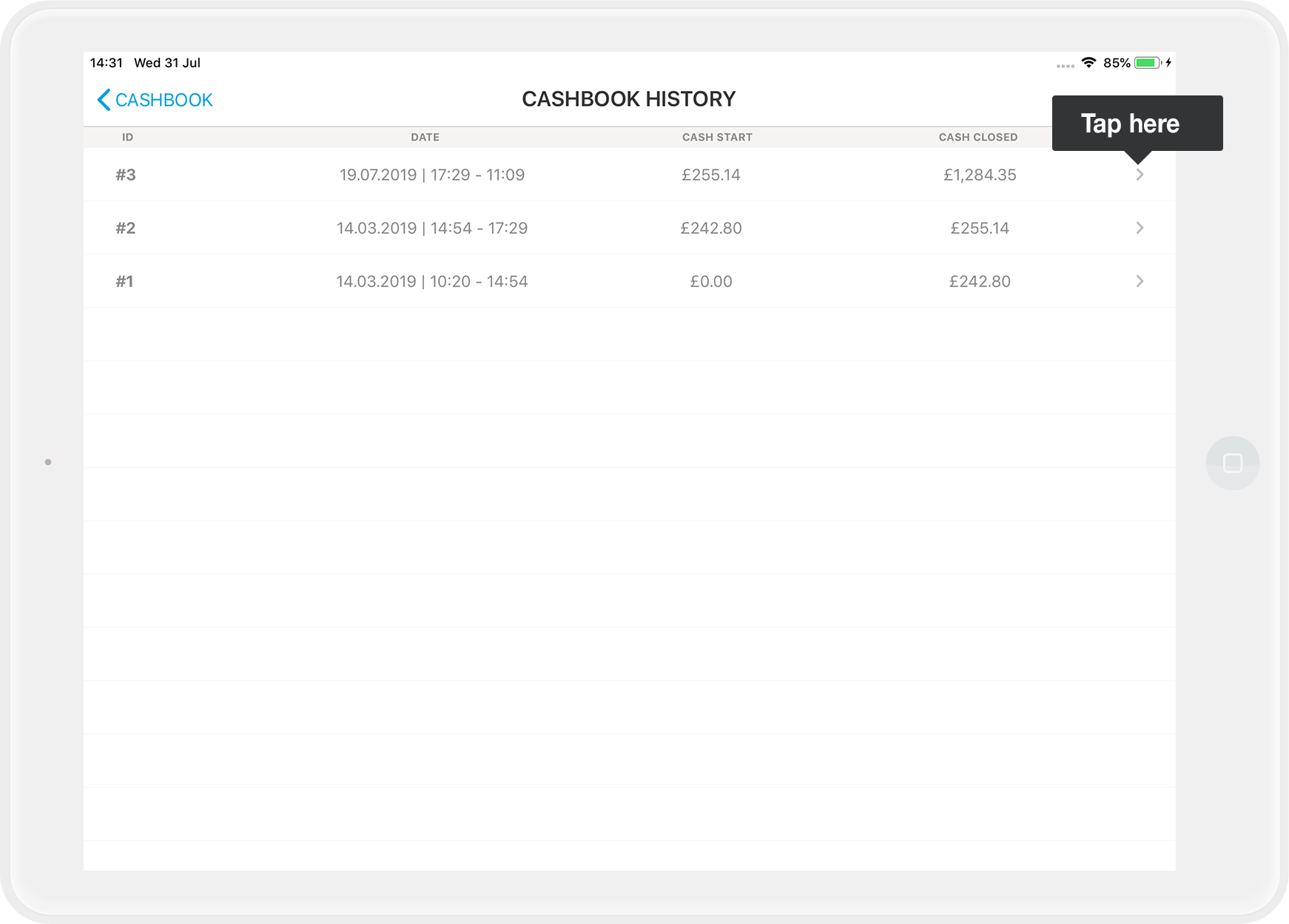

- Now select the cash sheet for which you want to export the data from the cash book and tap on the small arrow on the right side of the line.

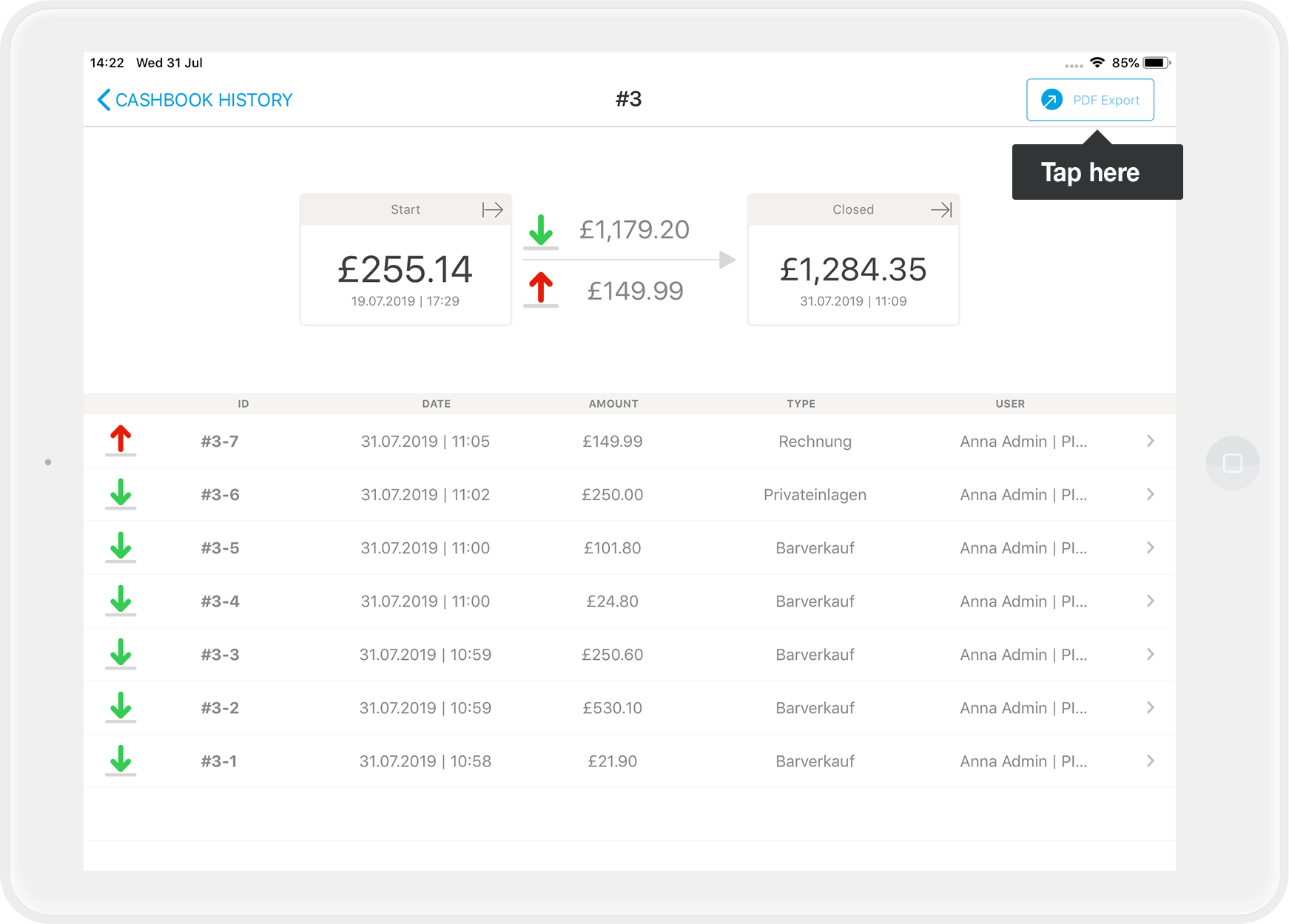

- You will now see all cash receipts and cash expenditures for the selected cash journal. Tap on "PDF Export" in the upper right corner.

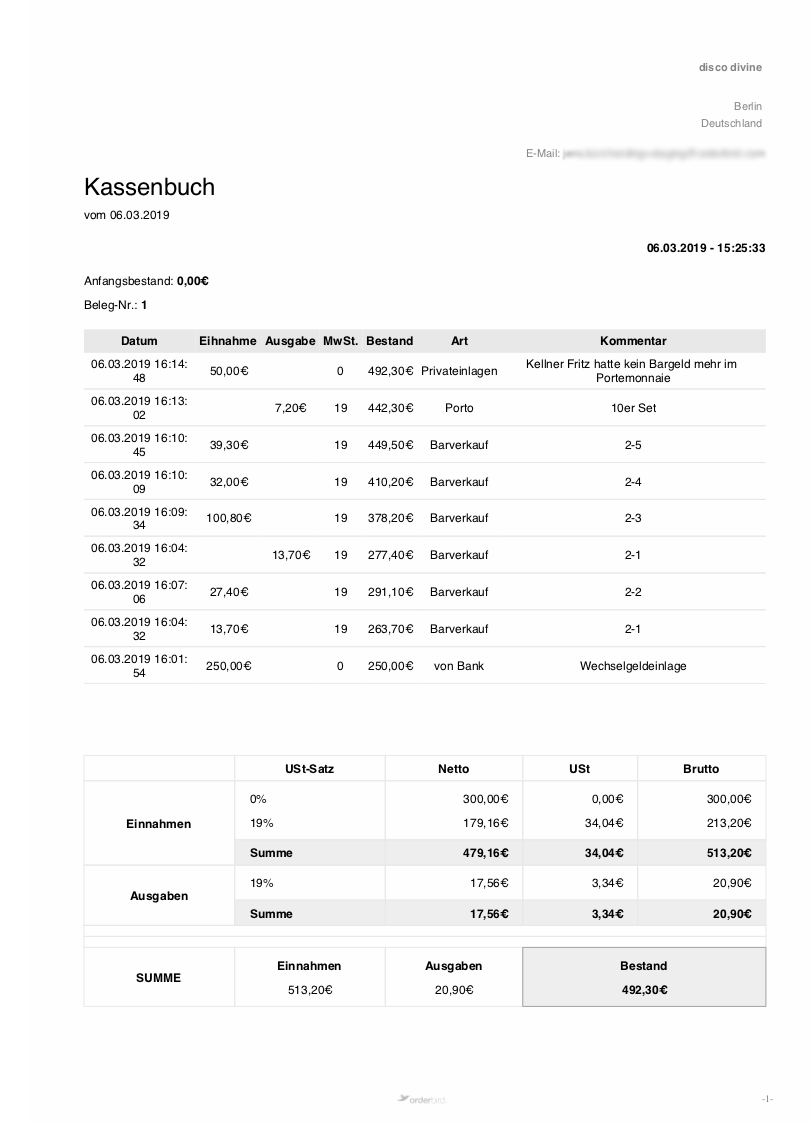

- Check your email inbox: The PDF will be sent to the email address you used to register with MY orderbird.

- And that's how it looks:

Any questions?

Is it possible to export the receipt photos?

If you take receipt photos directly through the cash register book, they will only be displayed as a preview in the cash register book and cannot be exported. To add receipt photos later to your CSV export, we recommend taking the receipt photos separately as described here: How can I export my receipt photos from the cash book? This way, you’ll have an additional digital copy of the receipt on your iPad in the Photo Library.

About legal or tax advice

orderbird does not offer any legal or tax advice. All information with legal or tax aspects is in no case to be regarded as legal or tax advice.

However, in order to provide you with the most reliable guidance possible, our cooperation partner, the Berlin-based tax firm Buder (https://steuerbuder.de), has examined the following procedure for dealing with the orderbird cash book and found it to be correct with regard to tax-relevant aspects. Nevertheless, it is possible that the procedures suggested here are not applicable to you and your company in particular.

Therefore please contact your tax advisor for a binding statement on how to use the orderbird cashbook correctly. Both orderbird and Steuerkanzlei Buder exclude any liability for the topicality, correctness and completeness of the information provided here by orderbird with regard to tax procedures.