About legal or tax advice

orderbird does not offer any legal or tax advice. All information with legal or tax aspects is in no case to be regarded as legal or tax advice.

However, in order to provide you with the most reliable guidance possible, our cooperation partner, the Berlin-based tax firm Buder (https://steuerbuder.de), has examined the following procedure for dealing with the orderbird cash book and found it to be correct with regard to tax-relevant aspects. Nevertheless, it is possible that the procedures suggested here are not applicable to you and your company in particular.

Therefore please contact your tax advisor for a binding statement on how to use the orderbird cashbook correctly. Both orderbird and Steuerkanzlei Buder exclude any liability for the topicality, correctness and completeness of the information provided here by orderbird with regard to tax procedures.

Let's start

You are obliged to enter all cash withdrawals in the cashbook. These are e.g. the payment of a supplier, a private withdrawal or if you take cash from the cash register to make a deposit to your business account. You must also enter the theft of cash or tips in your cash book! No matter what the reason for a cash withdrawal is, document it carefully in and create a receipt for your cash book!

Step by step

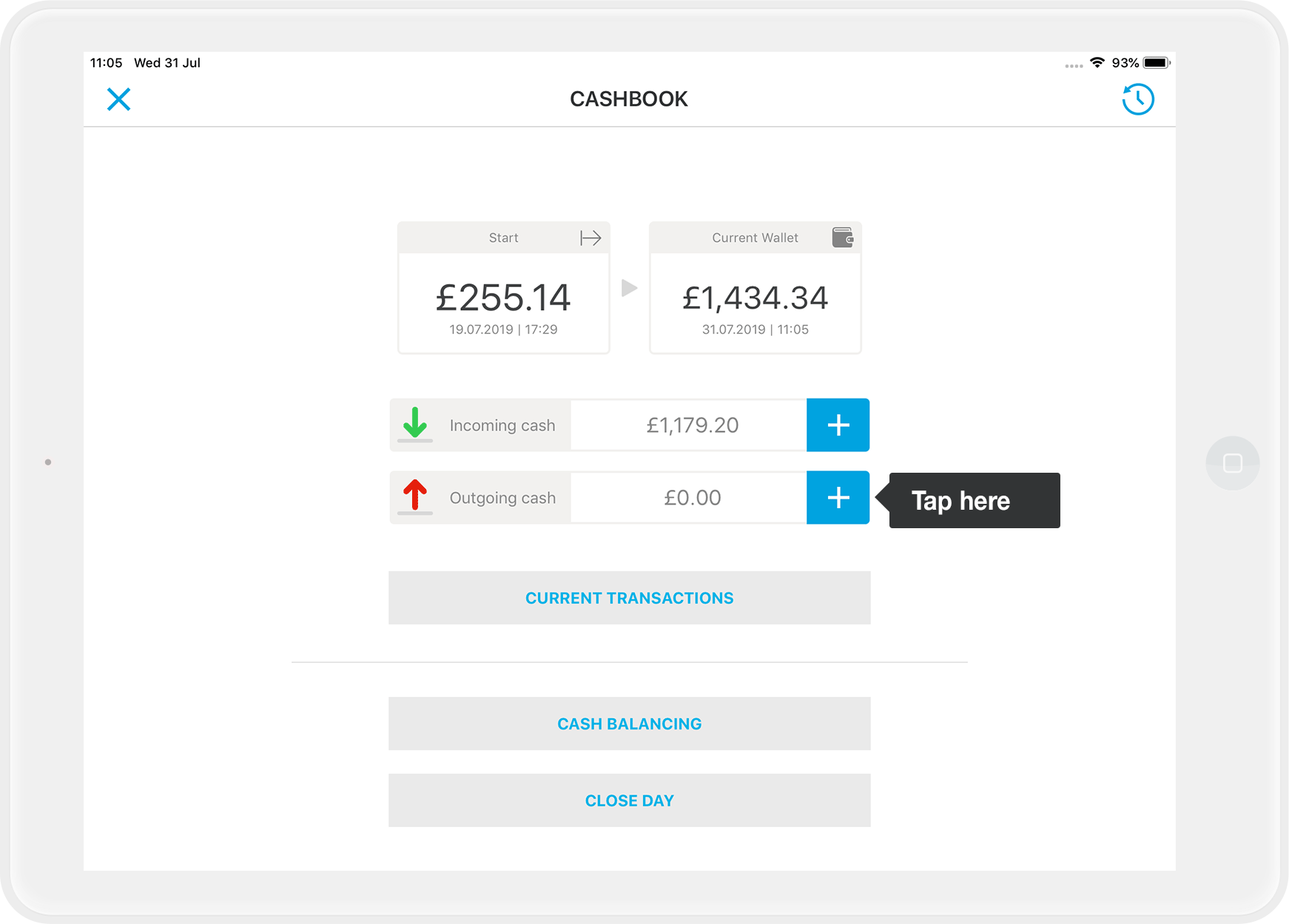

- In the cash book tap on the "+" symbol next to the option "Outgoing Cash".

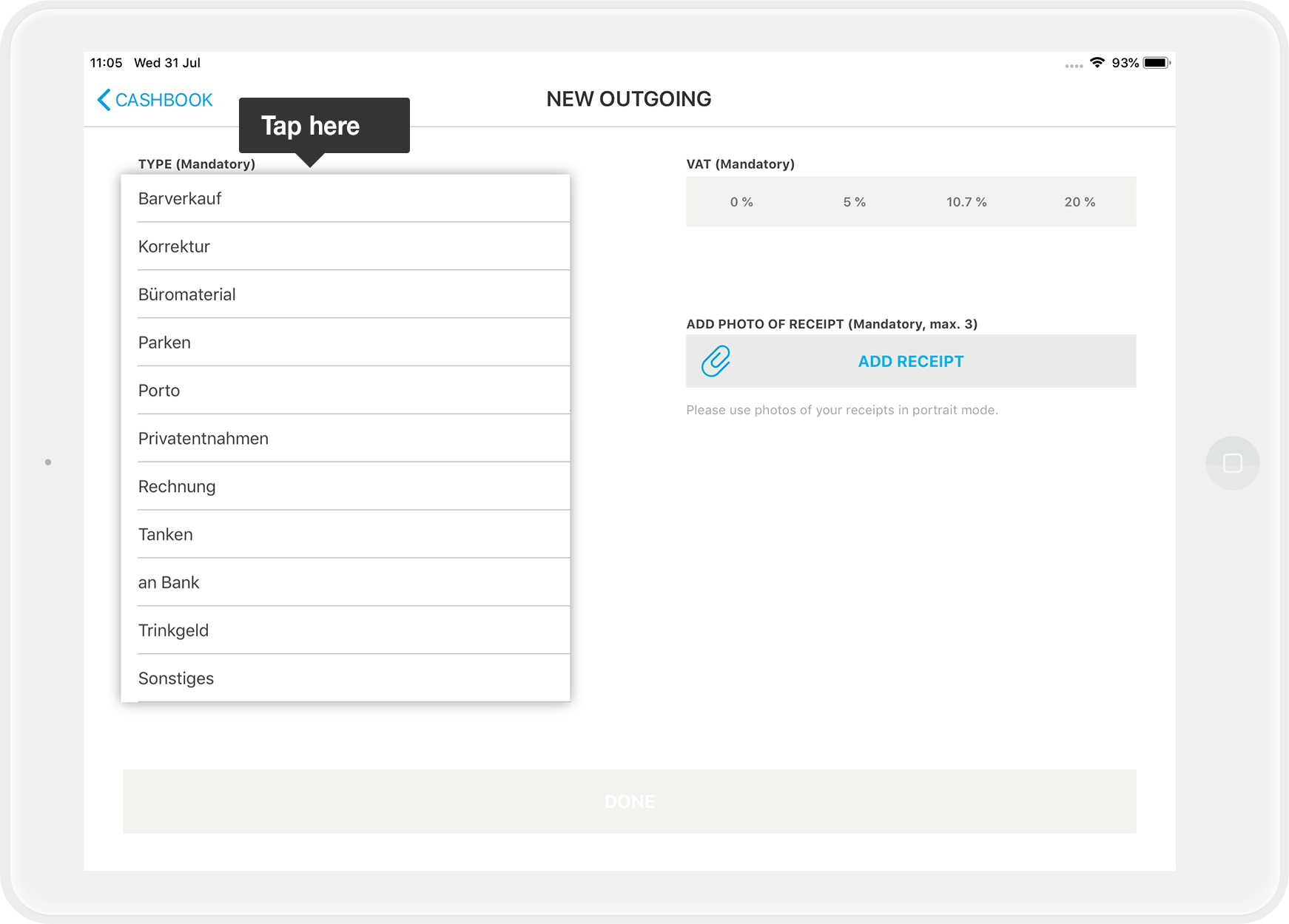

- Then select the type of issue (mandatory field). For example "Delivery".

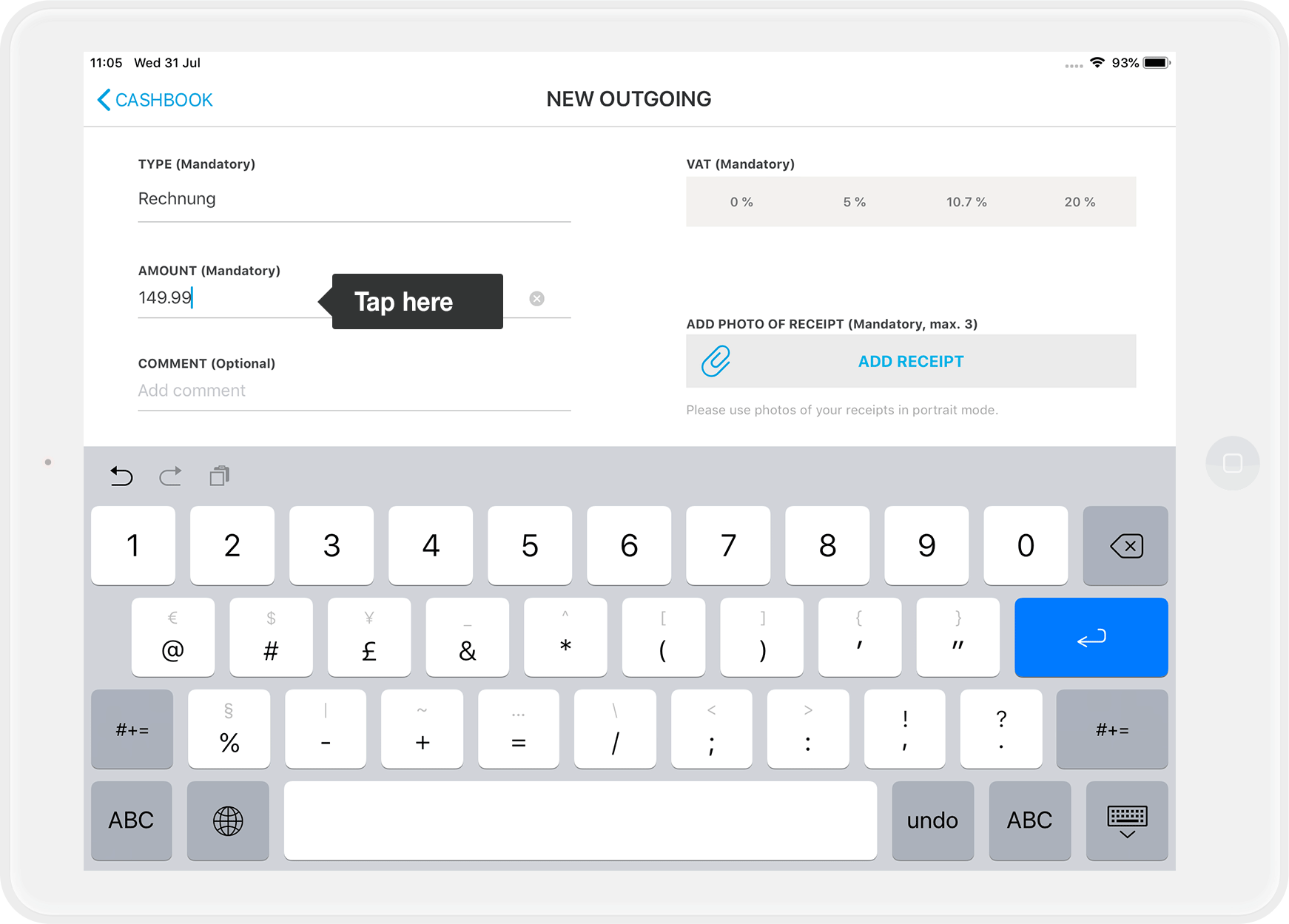

- Enter the amount.

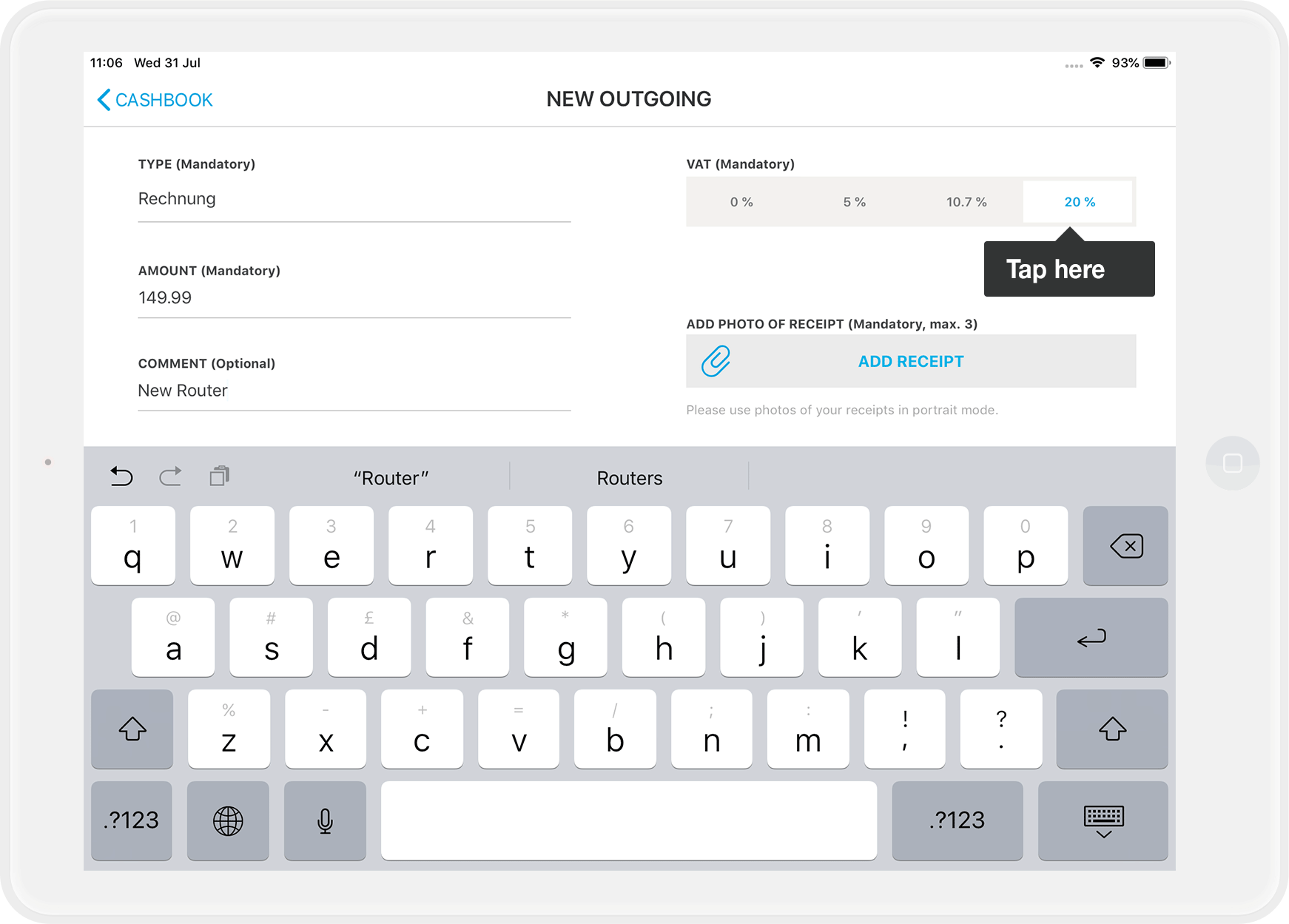

- Select the correct tax rate (mandatory field). If you pay a supplier, you will find the tax rate on the invoice.

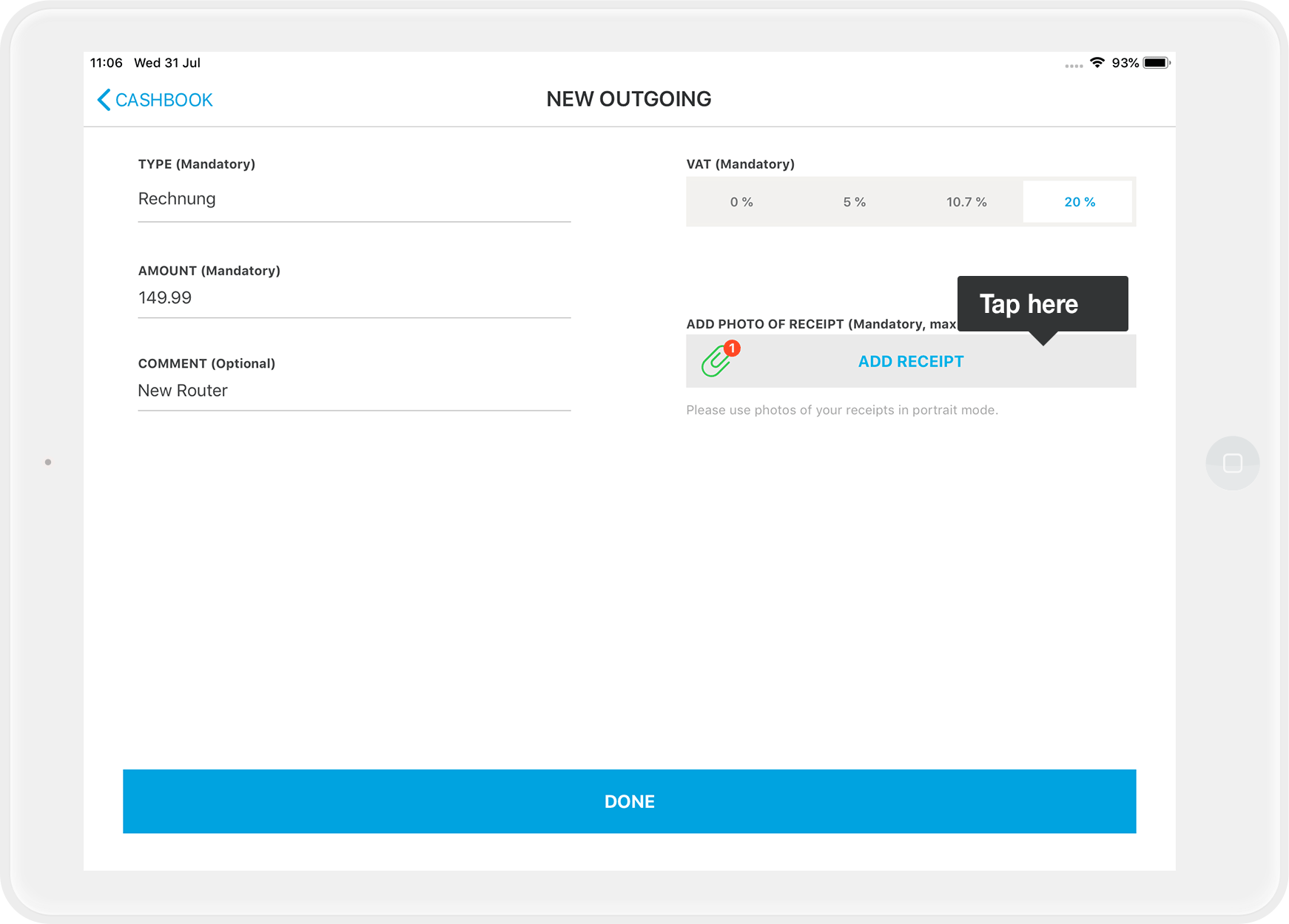

- Via "Add receipt" you can add a photo of the delivery receipt or the received invoice (mandatory field). This way you have everything digitally documented.

You can take up to three photos, which are also recorded for this withdrawal in the cash book. If you are not satisfied with the three photos, then stop the withdrawal and start again from the beginning.

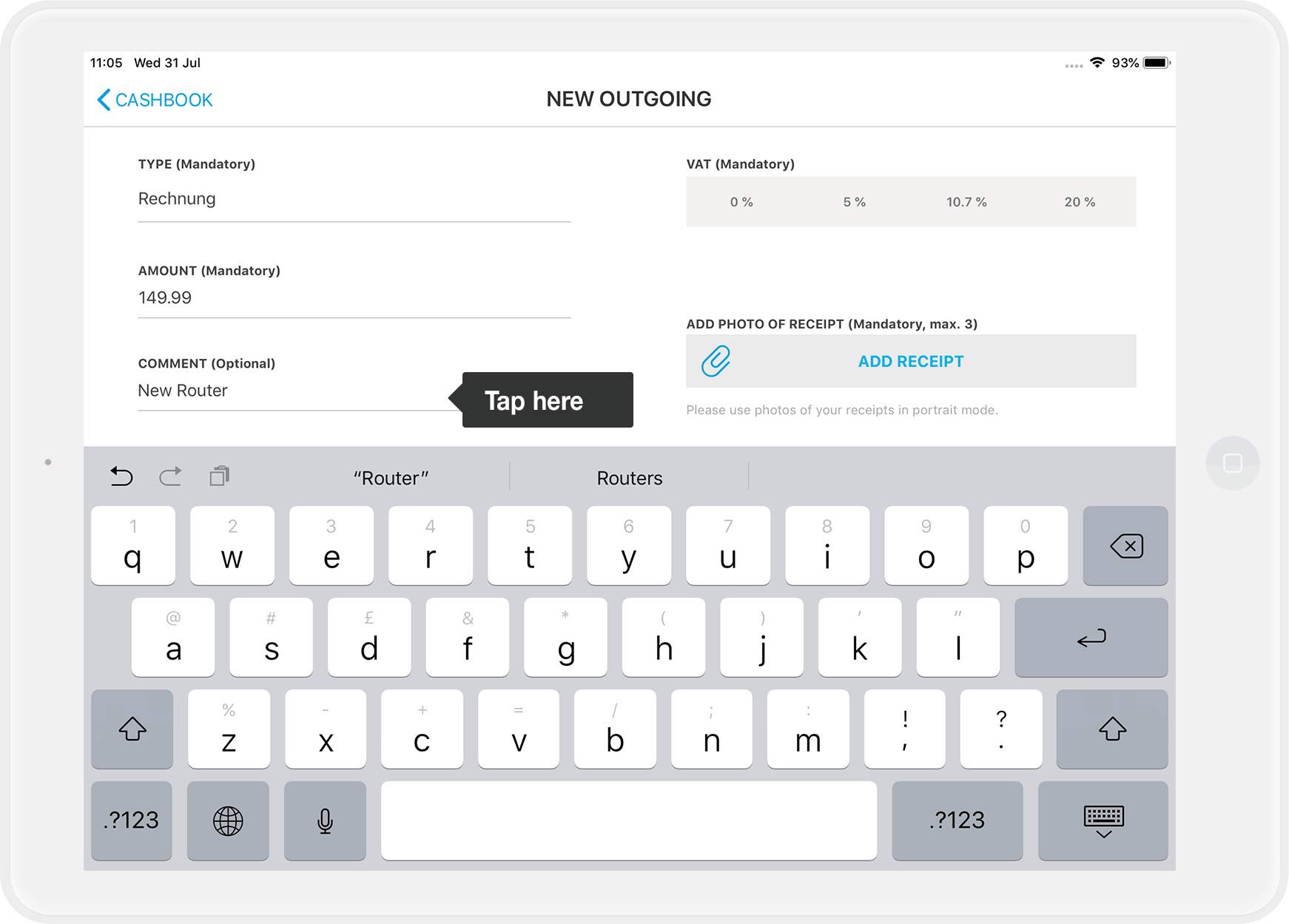

Important: Please keep the original receipt in a safe place! - Via the comment field (optional) you can describe the reason you are making this entry.

By the way: If you have to advance money privately, for example you have to get bread rolls in a hurry, you enter the date of the day you took the money from your point of sale.

- Tap on done - that's it!