How do I enter cash income in the cash book

Table of Contents

Let's start

All information about your cash income belongs in the cash book, without any gaps: You have to register any cash deposits, tips received in cash, as well as all other cash income in your cash book. Always remember to document everything with a receipt!

Capturing cash income - step by step

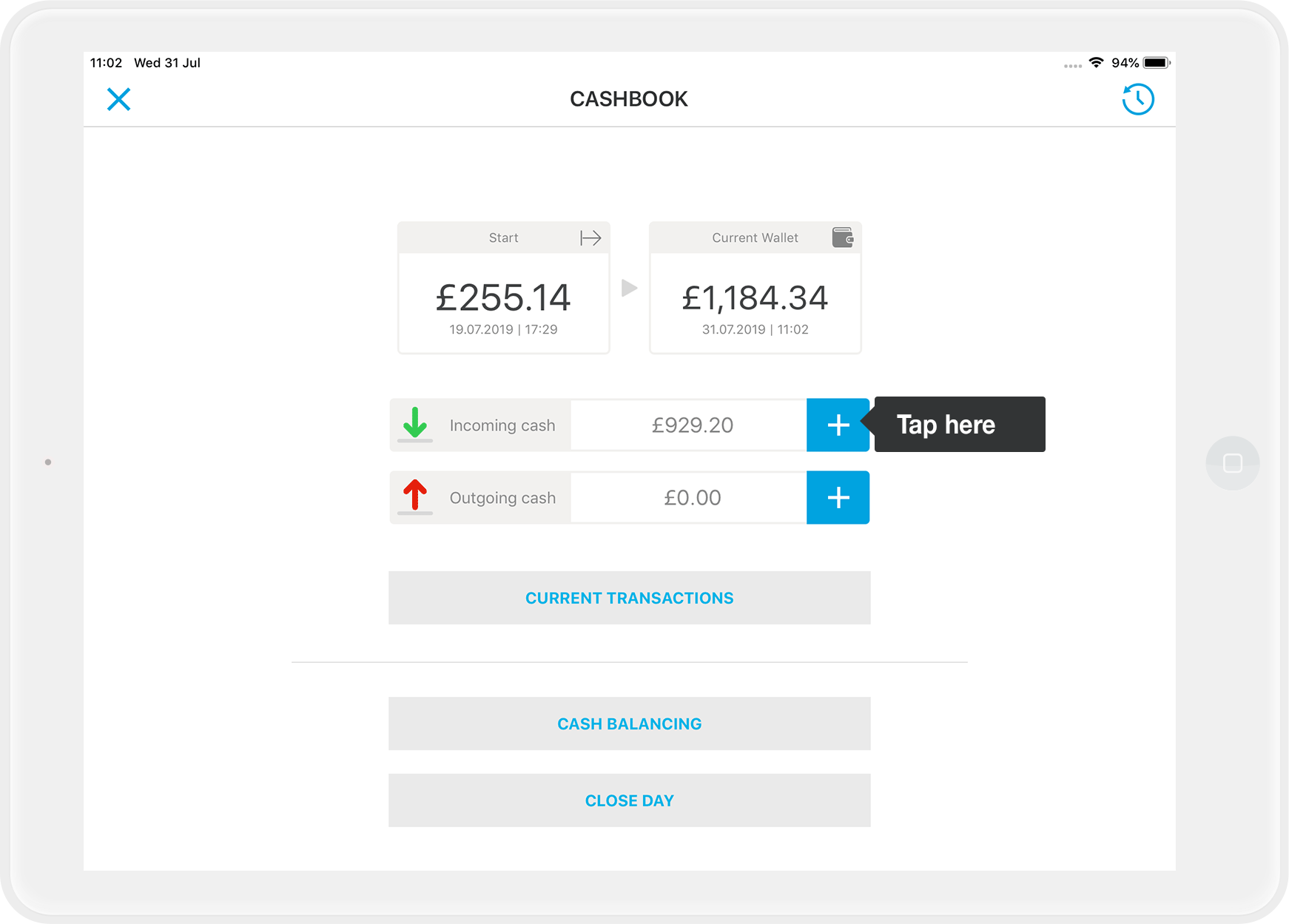

- Tap on the "+" symbol next to "Incoming cash" item in the cash book.

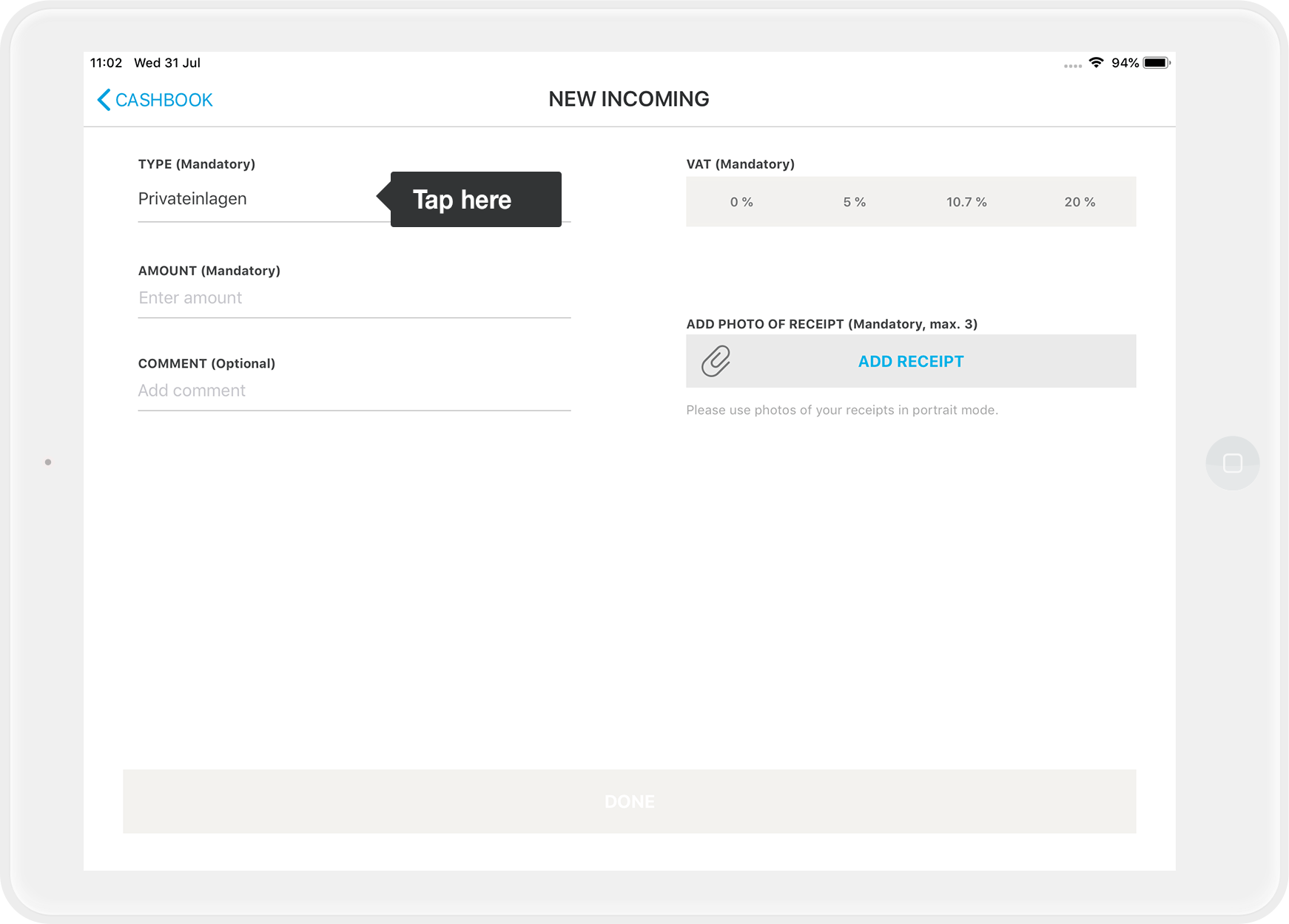

- Then select the type of income, for example "Private deposits" (mandatory field).

- Enter the missing information

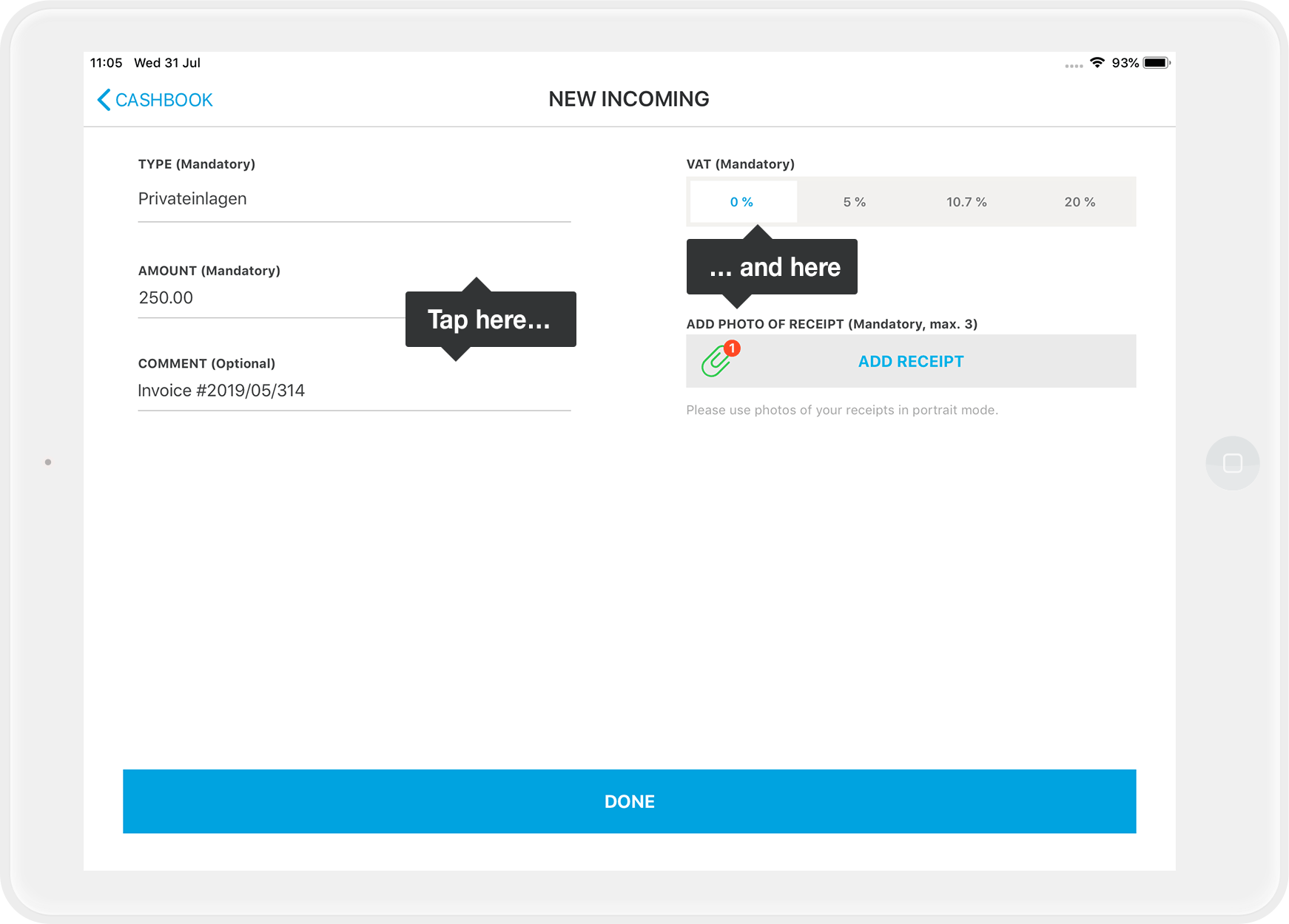

- Select the correct tax rate (mandatory field). You also note this on the invoice or receipt if you write one. A cash transit (bank to cash) is not a tax process, so you note it as "tax-free" in the app.

- Via a comment (optional) you can describe in more detail why you are making this entry.

- Via "Add receipt" you can add a photo of the receipt, e.g. the bank receipt or your own receipt (mandatory field). This way, you can immediately document everything digitally: You can take up to three photos, which are also recorded in the cash book in the order they are taken. If you are not satisfied with the three photos, you stop taking them and start again from the beginning.

Important: Please remember to keep the original receipt in a safe place!Export Receipt Photos?

If you tend to misplace your original receipts often, we recommend taking receipt photos separately. How can I export my receipt photos from the cash book? This way, you’ll have a digital copy of the receipt on your iPad in the Photo Library.

- Select the correct tax rate (mandatory field). You also note this on the invoice or receipt if you write one. A cash transit (bank to cash) is not a tax process, so you note it as "tax-free" in the app.

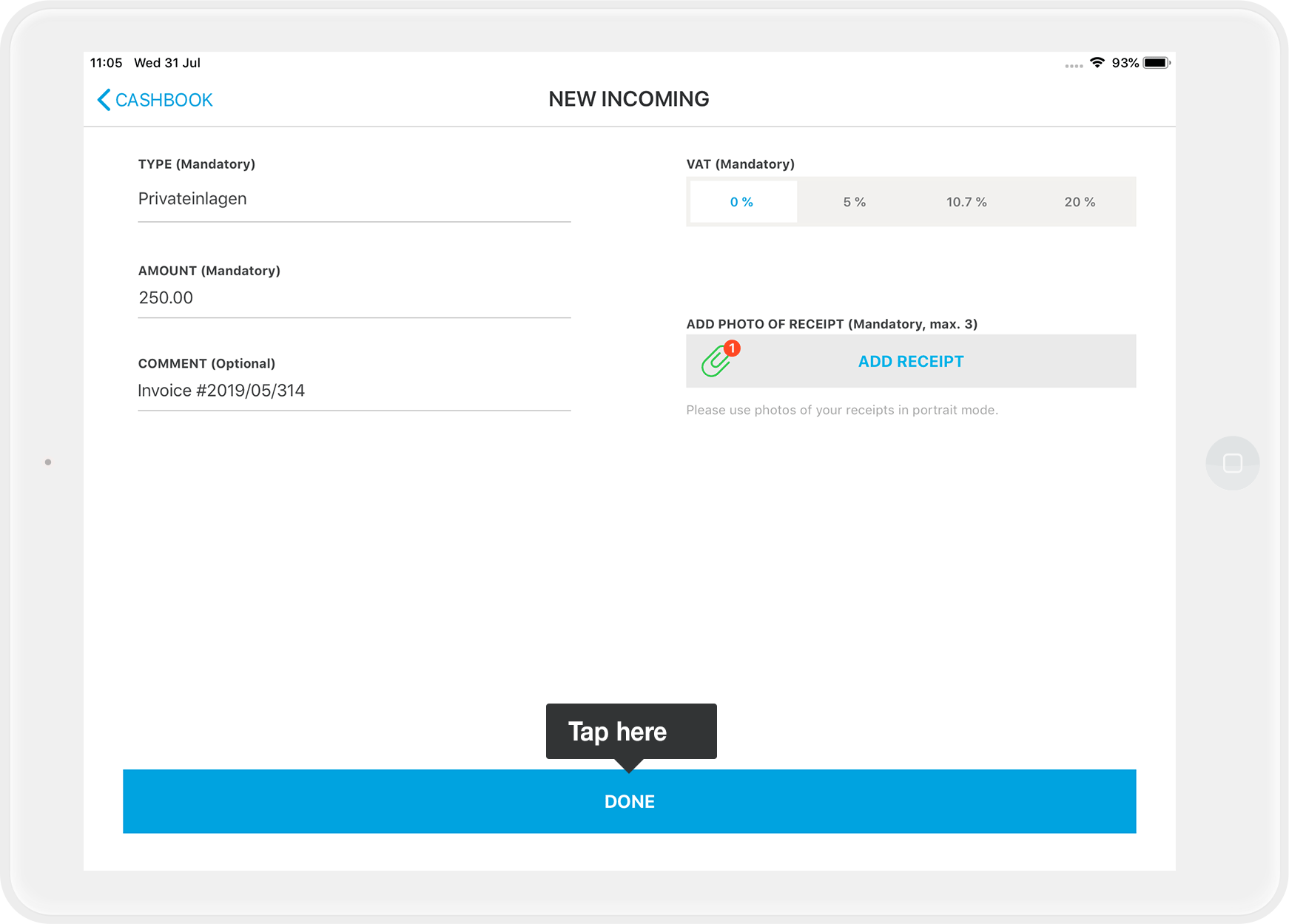

- Tap "Done" and you are fine!

Regarding Legal and Tax Advice

Regarding Legal and Tax Advice

Please note: orderbird does not provide legal or tax advice!

Everything we write reflects our experience and the experiences of our customers. Any information related to legal or tax aspects should not be considered legal or tax advice under any circumstances. Therefore, a procedure we describe may not be applicable to you or your business specifically.

For definitive statements, please consult your tax advisor. orderbird disclaims any liability for the accuracy, correctness, and completeness of the information provided here regarding tax-related procedures.