How do I do a cash check?

Table of Contents

Let's start

With the help of the cash balancing in the orderbird cashbook you can do a cash counting at any time, in order to compare the debit balance with the actual amount of cash in your point of sale.

Check the cash balance at least once per day, preferably before you finish work: You are actually obliged to do this!

If your waiters work in a shift system, we also recommend that you make a cash check every time a new waiter shift starts. This allows you to quickly recognize if there are inconsistencies in the cash balance and to correct the error promptly. If this is not possible for you, discuss how to proceed with your tax advisor.

Step by step

- Open the orderbird app and tap "Cashbook" in the main menu.

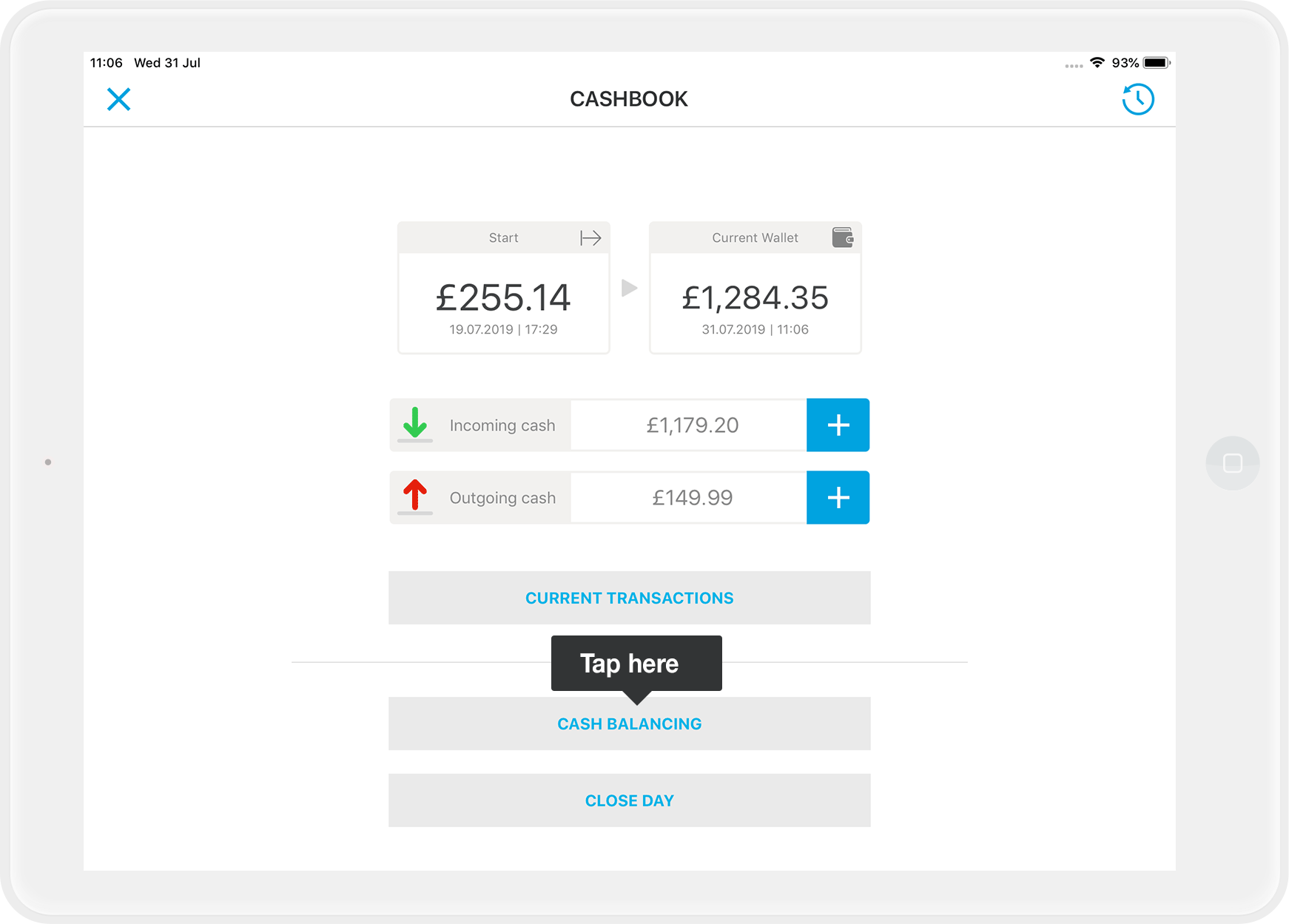

- Tap on "Cash balancing".

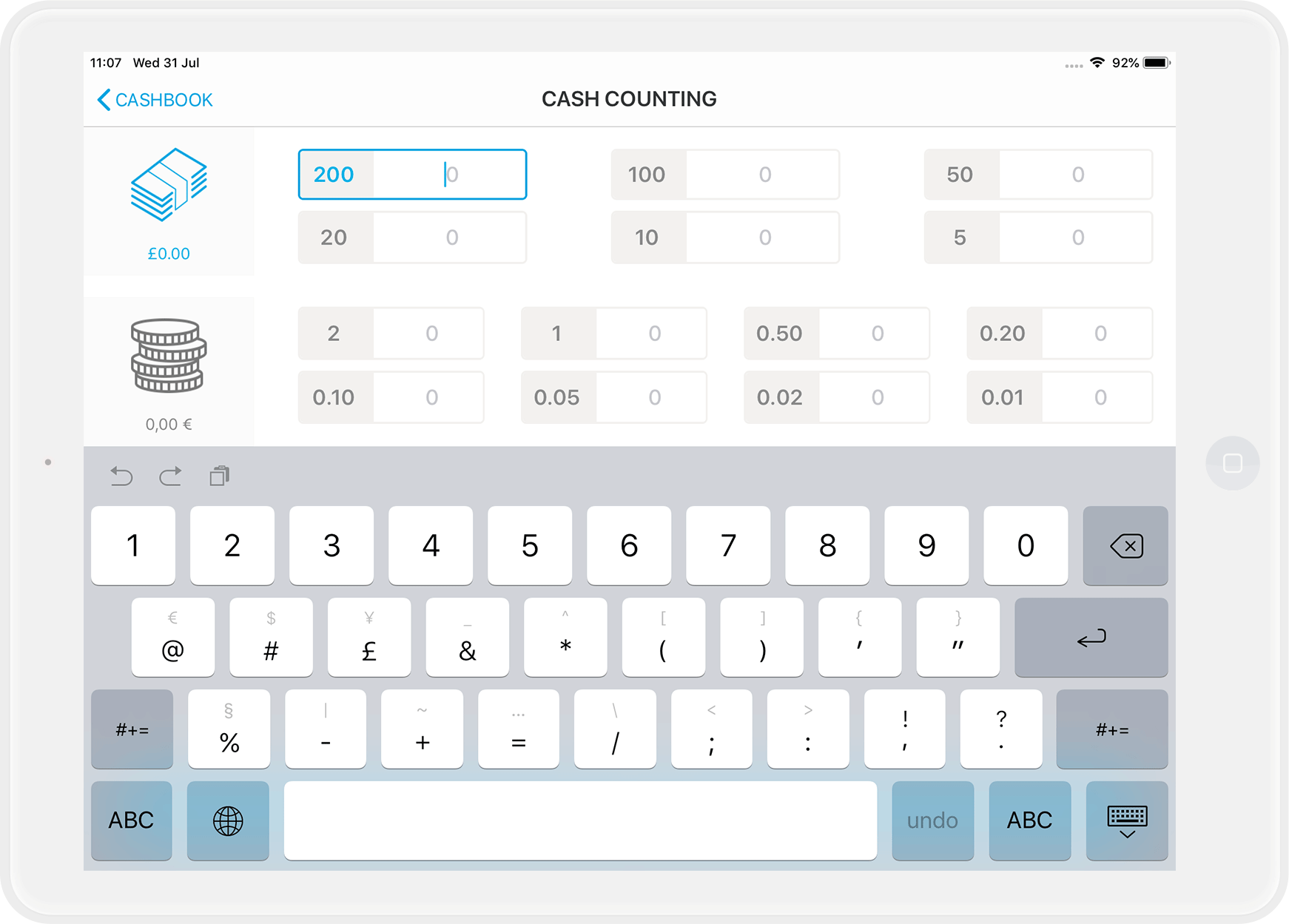

- In the cash counting you enter the amount of notes and coins of each type. The sum will be calculated automatically from your entries.

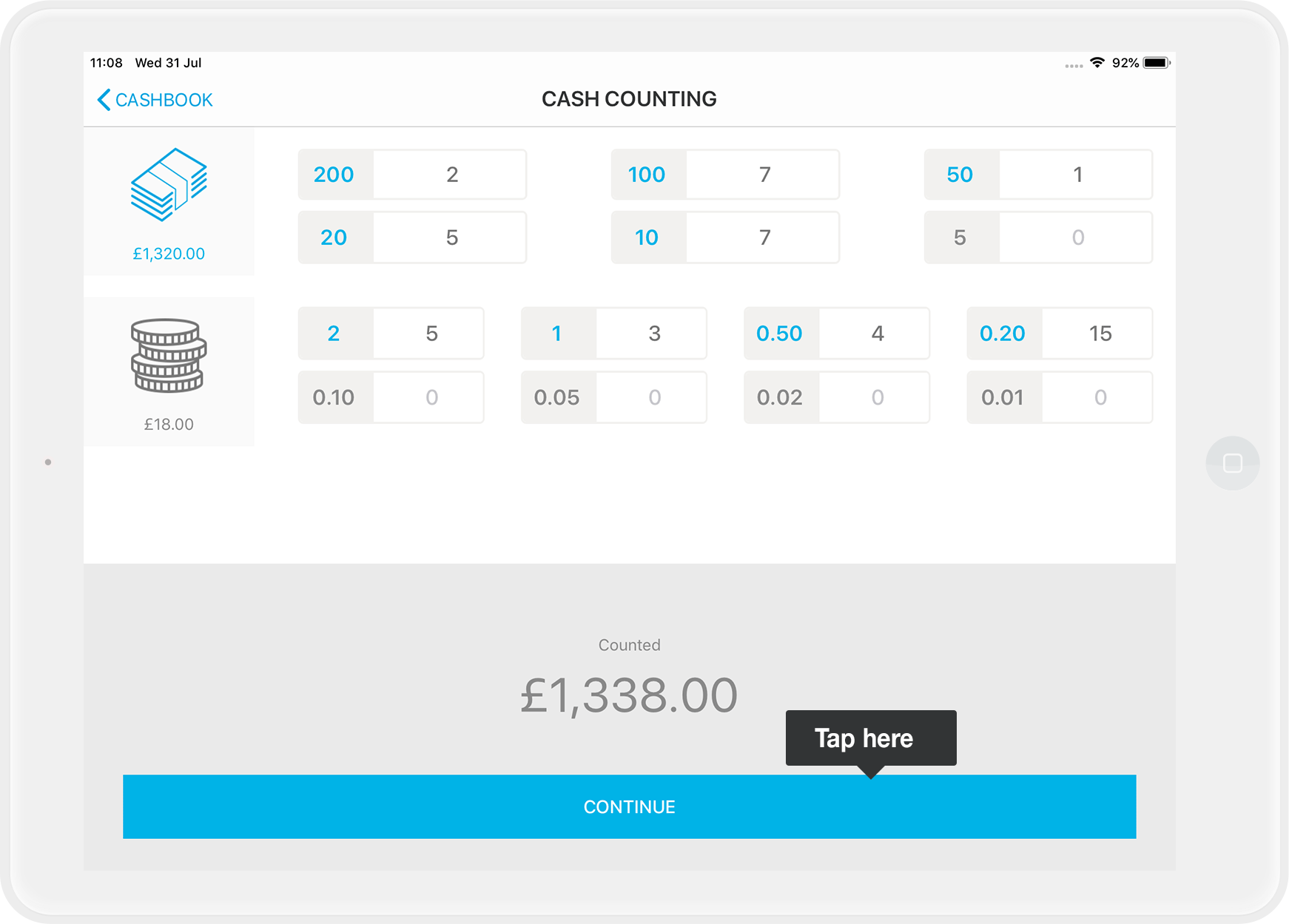

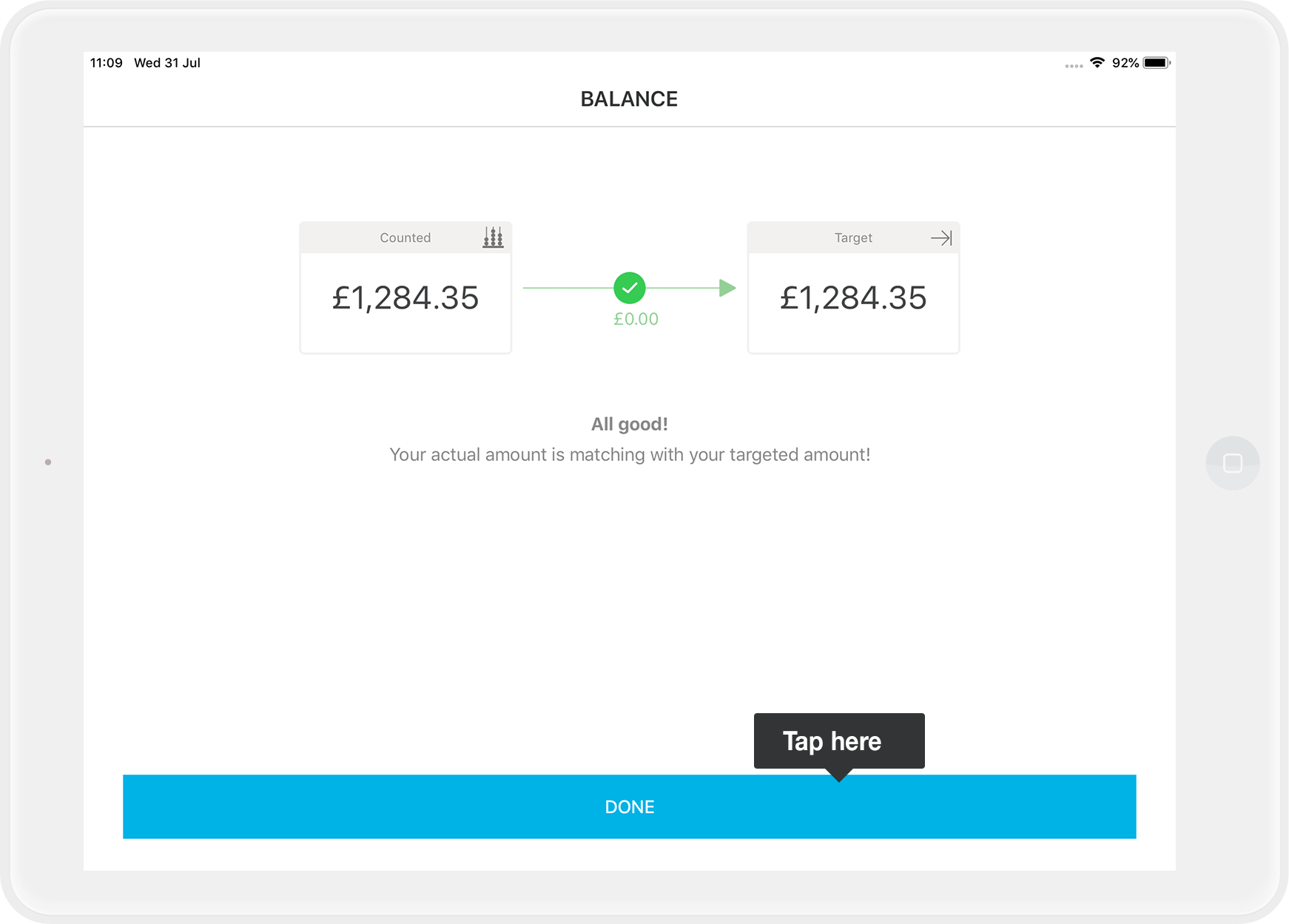

- Does the final sum of the actual amount of cash in your point of sale correspond to the sum of the debit balance?

Super, everything is fine :) Tap on "Continue" to end the cash check.

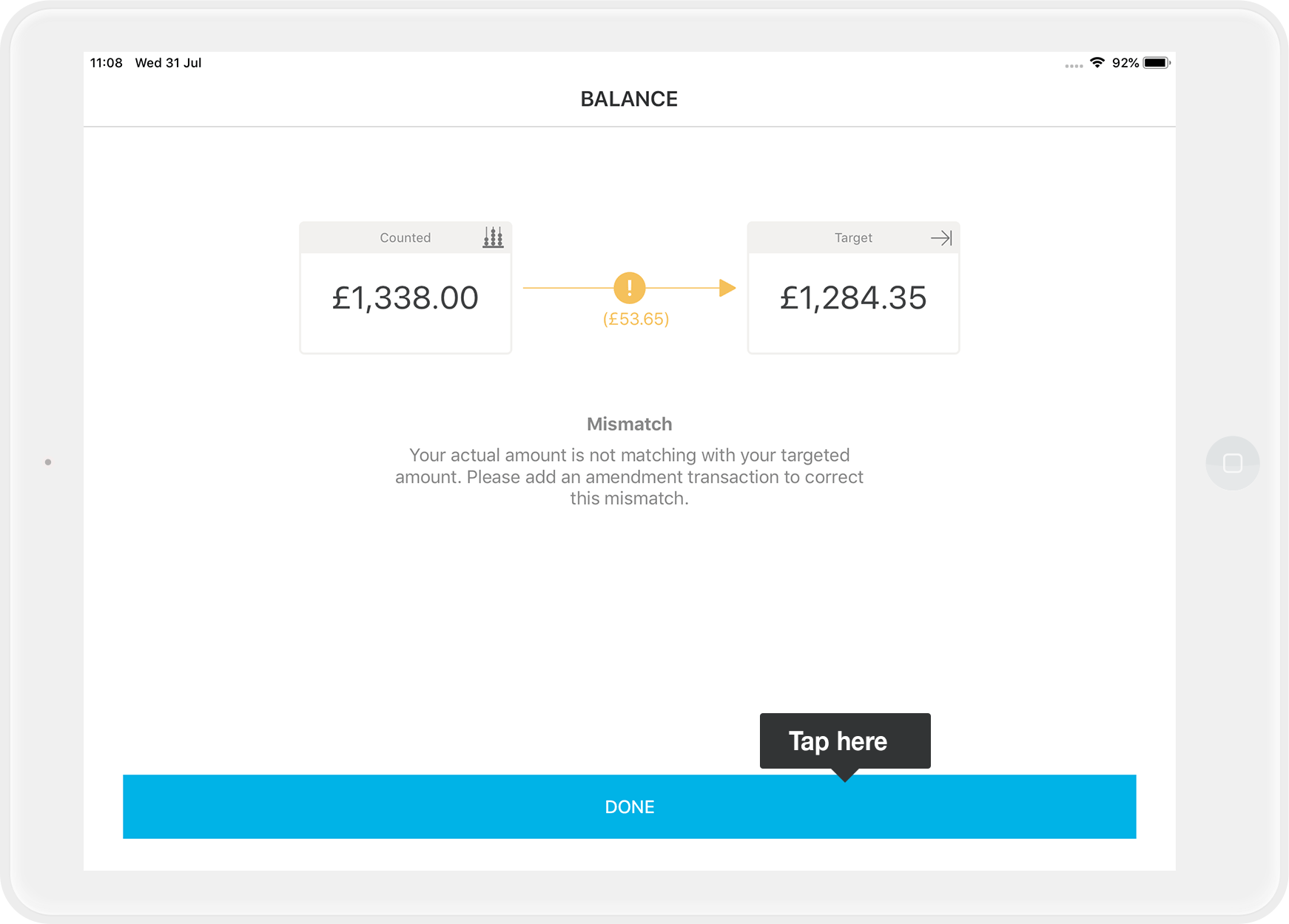

- If there is a discrepancy between the actual amount of cash in your point of sale and the sum of the debit balance, you have to act immediately: Maybe you forgot to enter a tip, maybe a withdrawal of cash? The faster you correct this discrepancy, the fewer options to criticize your cash book by an auditor occur.

You can find out how to complete forgotten entries or correct erroneous entries here: How can I correct wrong entries or forgotten entries?

About legal or tax advice

orderbird does not offer any legal or tax advice. All information with legal or tax aspects is in no case to be regarded as legal or tax advice.

However, in order to provide you with the most reliable guidance possible, our cooperation partner, the Berlin-based tax firm Buder (https://steuerbuder.de), has examined the following procedure for dealing with the orderbird cash book and found it to be correct with regard to tax-relevant aspects. Nevertheless, it is possible that the procedures suggested here are not applicable to you and your company in particular.

Therefore please contact your tax advisor for a binding statement on how to use the orderbird cashbook correctly. Both orderbird and Steuerkanzlei Buder exclude any liability for the topicality, correctness and completeness of the information provided here by orderbird with regard to tax procedures.