Step 3: Creating a Registrierkassen-WebService on FinanzOnline.at

Table of Contents

Since you use an online solution for your cash register with orderbird and fiskaltrust, this step will guide you through creating a user for the "Registrierkassen-WebService" in addition to your regular user on FinanzOnline.at.

Who should proceed: you or your tax consultant?

At this stage, you have the option to pause and let your tax consultant handle the registration for the Registrierkassen-WebService. They are familiar with the process and can manage it on your behalf, but keep in mind that different rules apply to them according to the Federal Ministry of Finance (BMF).

Excursus for your tax consultancy

The Federal Ministry of Finance provides a detailed manual for tax advisors: Handbuch as PDF in German

Refer to section 4.1.3 on page 54 for relevant instructions.

Tax consultants should navigate to the menu "Eingaben" > “Registrierkassen” for a tailored interface (according to the BMF, tax advisors use a different interface than their clients). Therefore, tax consultants must follow the instructions above to create the "Benutzer für den Registrierkassen-WebService".

Proceeding without a tax consultant?

If you’re handling this yourself, great job! Follow these steps to set up your own Registrierkassen-WebService:

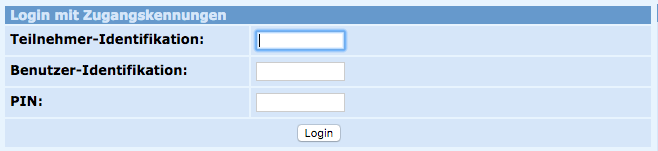

- Log in to https://finanzonline.bmf.gv.at using the access data provided by your tax office.

- Click on “Admin” in the top navigation bar. In the new window, select "Benutzer Einzel".

- Enter the "Benutzer-Identifikation" of your choice in the search field on the right side and check the box "Ich möchte einen neuen Benutzer anlegen". Click "Anfordern".

- In the following window, click on "Bearbeiten" under "Benutzererkennung/Benutzerarten":

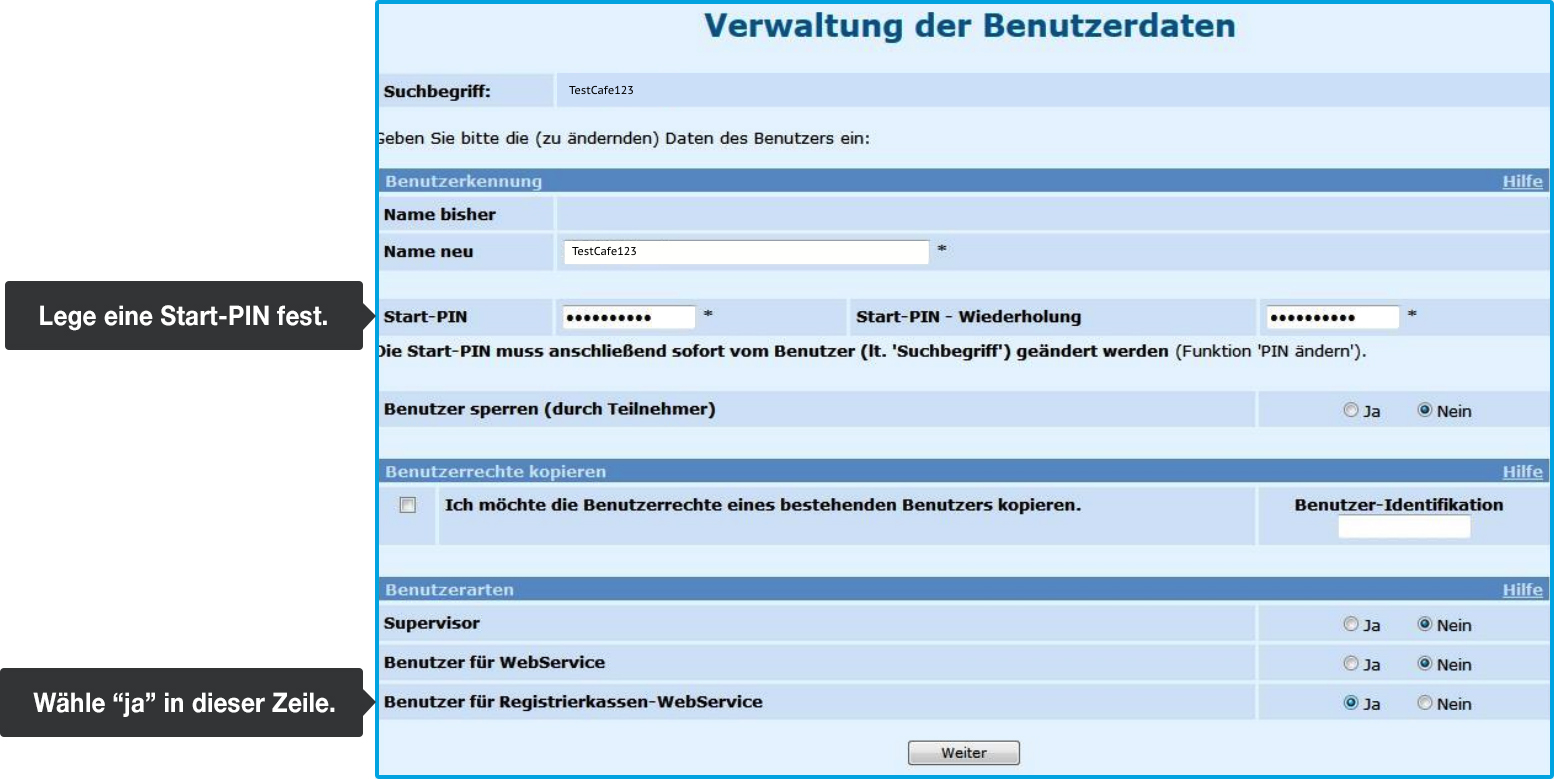

- Create a "Start PIN" of your choice and confirm it by entering it again in the corresponding field. (The Start PIN must be 8–12 characters long and include at least one letter and one number. Special characters are not allowed). For “Benutzer für Registrierkassen-WebService”, select “Ja”. Confirm your entries by clicking "Weiter":

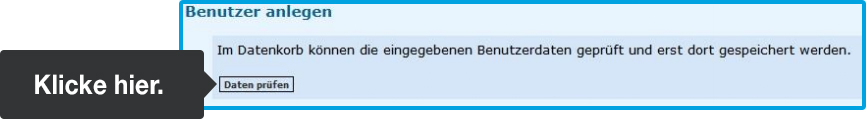

- At the bottom of the next page, titled "Verwaltung der Benutzerdaten-Übersicht", find the "Benutzer anlegen" section and click “Daten prüfen”:

- In the subsequent window, review all saved changes to ensure accuracy.

- If all data is correct, finalize the registration. Enter your new user identification and PIN on your overview.

Note: The participant identification is the same as for your regular FinanzOnline.at access data.

Now log out by clicking on the “Ende” at the top of the page.

Need to make some corrections? Click on “zur Übersicht” at the bottom of the page to adjust your entries.